Correction Watch List

Hi everyone! Thanks again for reading.

In this newsletter, I plan to share at least 1-2 emails a month that help you identify potential high quality investments. Please note, most of my articles are not diving into deep due diligence and they are not meant to be financial advice, however, they are investments and/or ideas that I find compelling and may invest in.

Let’s jump in!

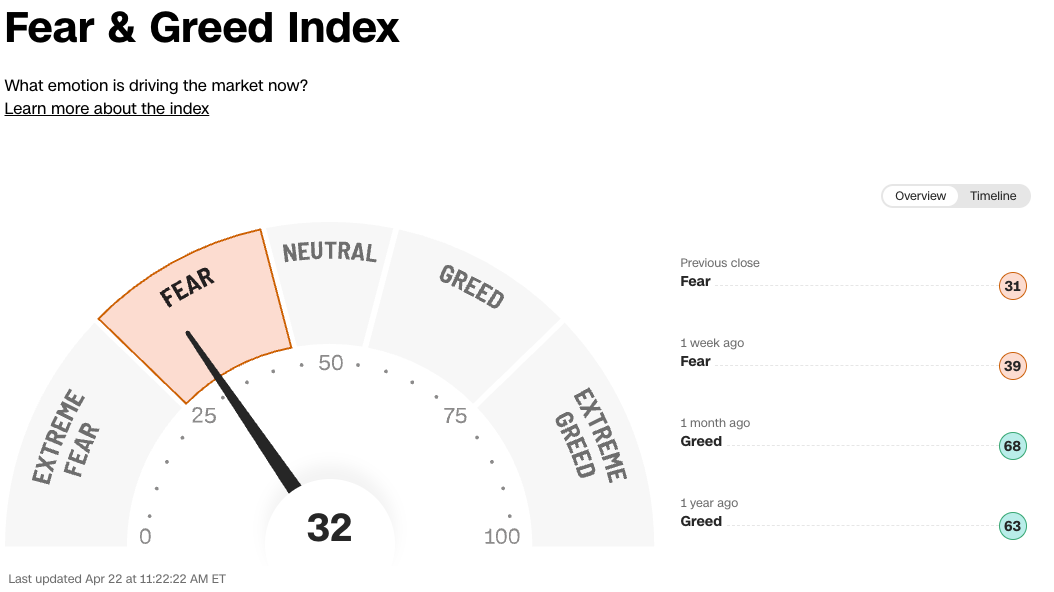

Markets are in (a very small) correction with many individual stocks dropping far more with the significant uptick in rates and prolonged expectation for higher interest rates.

The Fear & Greed Index also shows plenty of fear finally:

Here’s a few companies I’m currently investing in or watching closely:

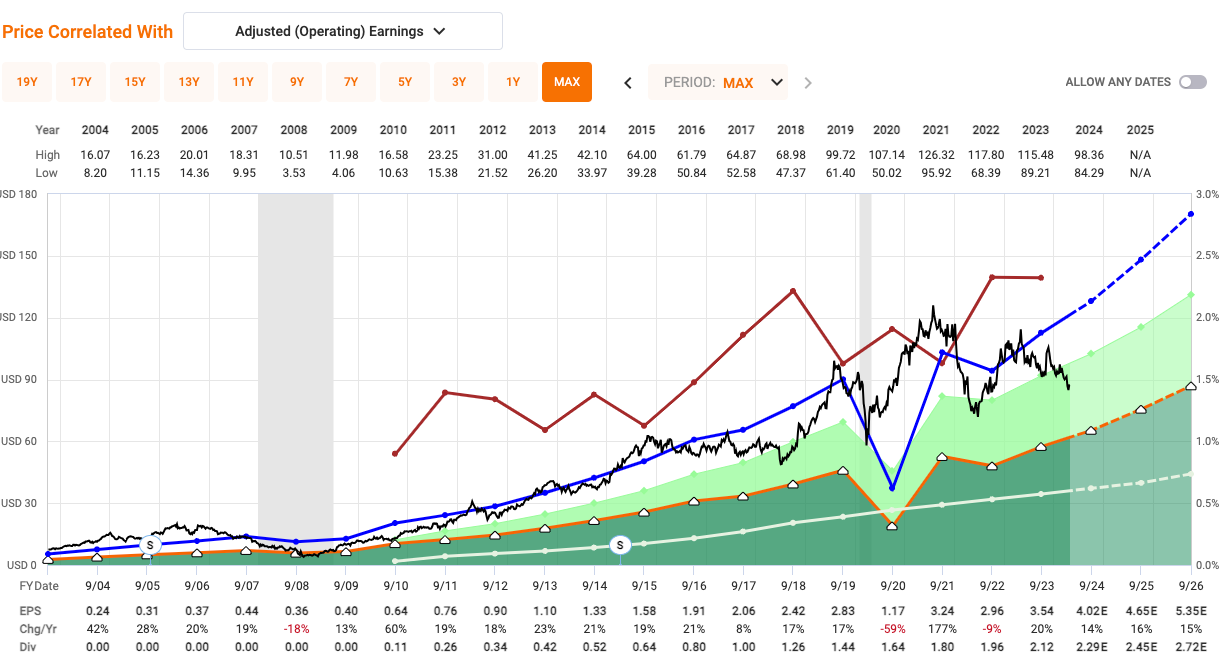

Starbucks (SBUX): Starbucks is a well known brand that has been a long term compounder since GFC. As such, it’s commanded a pretty significant PE premium in its history outside of GFC when the brand was in crisis. There are obvious risks with Starbucks, like it’s very high LT Debt/Capital (136.95%) and exposure to China, but the long term growth thesis seems like it’s still in tact. Currently, analysts expect 14%, 16%, and 15% growth in 2024, 2025, and 2026 respectively. Shares are down nearly 20% over the past year and down 6.11% YTD. At it’s current price, the forward PE ratio is 21.75, the dividend yield is 2.60%, and it’s 3y forward PEGY ratio is 1.31. In addition, the 3 year dividend growth rate is 8.53% which seems likely to continue in this range. Even if the long term PE stabilizes at a lower level moving forward of 20.92x, SBUX offers a potential total Ann RoR of 13.03% through 2026. If it reverts back to its historical PE, there is the potential for a 29.90% Ann RoR.

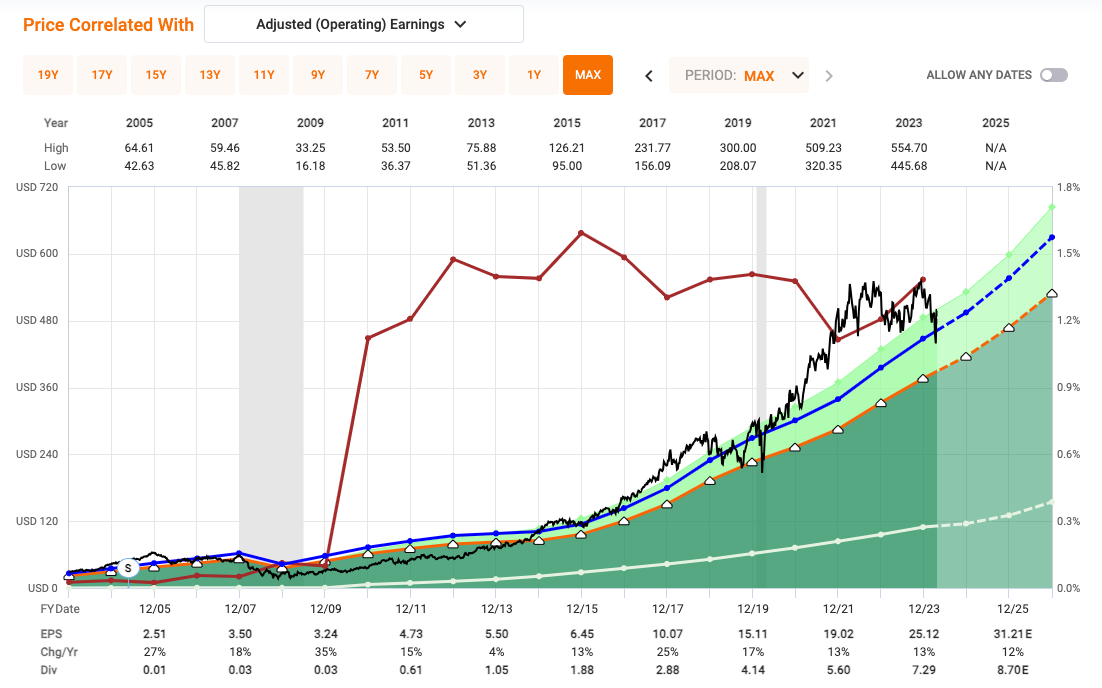

Zoetis (ZTS): Zoetis is the largest animal health company that was spun out by Pfizer. Since its IPO, it’s been a long term compounder that’s generally commanded a very significant premium PE valuation. Currently, sentiment on Zoetis has soured due to some alleged issues with one of their dog arthritis drugs. While the PE over the last 8 years or so has been around a 31.74x, it’s current forward PE is 25.35x after a 25.96% YTD decline. This presents a potentially interesting investment, though I’m still working to understand the business myself and I’m not in a rush to buy such a high PE (and a PEGY that indicates a hold) company just yet. At it’s current price, it has a 1.18% dividend yield and a 3 year forward PEGY ratio of 2.33. Dividend growth has averaged 23.04% over the last decade and it seems likely that ZTS can continue to increase the dividend in the double digits for time to come given it’s 28.20% payout ratio and expected EPS growth. If ZTS can hit it’s earnings growth, this investment may still perform well but has no margin of safety. If the PE returns to its historical premium, then it offers an 18.51% Ann RoR. However, if the PE returns reverts below 20x at this price point, a negative Ann RoR is possible through 2026.

Hims & Hers Health (HIMS): Hims is a modern, fast growing telehealth company targeting specific common treatments. You’ve likely seen their ads somewhere. This is a highly speculative investment, but one that I’ve allocated a position into with the recent sell off. I’m mostly curious to see if they can execute the way that management believe they can. If they are able to do so, this is definitely a multi-bagger. And if not, it’s overvalued in all likelihood. While the forward PE ratio is 156.46 today, EPS is expected to grow 187% in 2025 & 103% in 2026. It’s 5 yr avg PEGY ratio is 1.29, it’s 3 yr forward PEGY ratio is 0.95x, and it’s 2 yr forward PEGY ratio 1.08. With a healthy balance sheet and strong business model, I’m very interested to see how HIMS performs over time. At a 30x PE in 2026 with growth realized, HIMS offers a 21.43% Ann RoR potentially. A 30x PE seems very fair for what will likely still be a fast growing business beyond 2026.

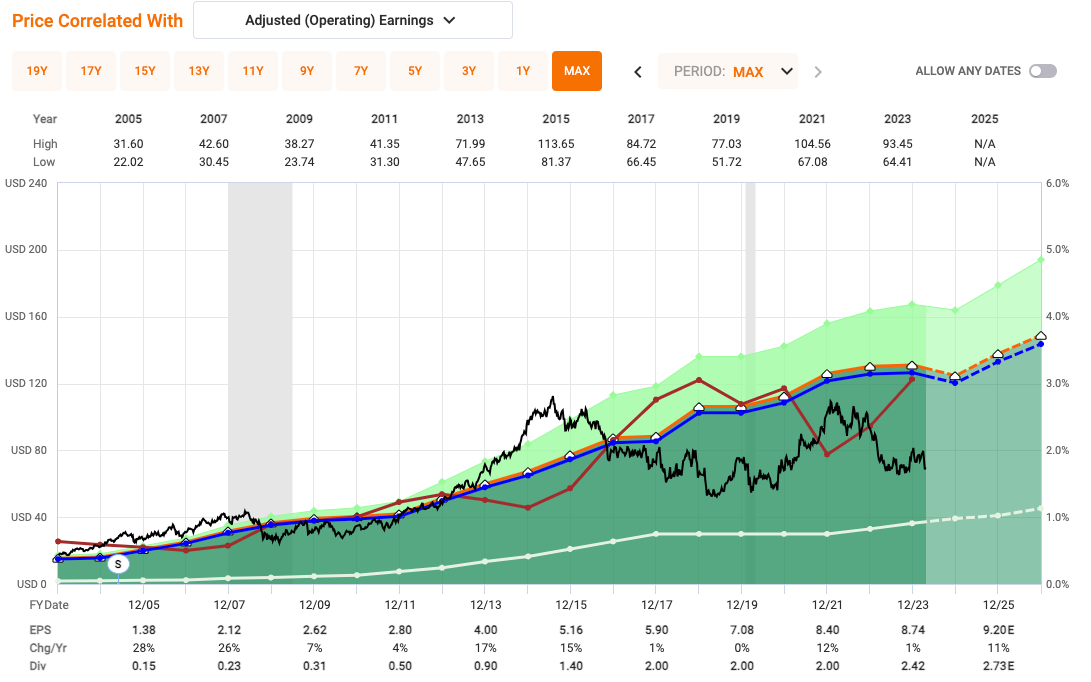

United Healthcare (UNH): When this company goes on sale, I buy. Today, I have a full position in UNH after the recent sell off into the $439 area. However, if it drops back down to this range or lower, I’d be more than happy to invest a little bit further. While there are risks that UNH faces, management is stellar and continues to deliver growth in the face of headwinds year after year. At it’s current price, the forward PE is 18.15, the dividend yield is 1.50%, and it’s 3 yr fwd PEGY ratio is 1.47. Given its 29.02% payout ratio combined with it’s expected double digit EPS growth, UNH is likely to continue to increase their dividend by 10%+ for time to come. While the current price today is arguably at a premium to it’s historical valuation, it still offers a 10.40% Ann RoR if growth is realized through 2026. At a lower price around $450, the PEGY ratio falls to 1.28 and offers a 15.81% Ann RoR at a 17.83x historical PE.

Humana (HUM): It’s been a rough year for Humana, and I’m loving it. While Humana has commanded a significant premium over the last 10 years, recent headwinds have exposed weaknesses at the company and created significant short term headwinds. As such, the stock price has fallen 30.80% YTD. With such negative sentiment, Humana presents a compelling investment with a 20.35x forward PE in a very down year with EPS expected to be down 38% in 2024. However, analysts also expect EPS will climb 43% in 2025 and 26% in 2026. The forward PEGY ratio can be calculated a few ways so it’s hard to pin it down, but I think HUM at this price point is pricing right around a sub 1 PEGY ratio which suggest a strong buy. I purchased a full position in HUM at $311.82 a few days ago, but it remains an enticing buy. At a 17.05x PE with growth realized through 2026, HUM offers a 17.55% Ann RoR through 2026. If the PE stabilizes at a lower multiple like 15x, HUM still offers a 12.25% Ann RoR.

CVS Pharmacy (CVS): Like much of the rest of the healthcare sector, CVS has taken a beating recently and is now down 13.88% YTD. While CVS does expect a 5% decline in EPS in 2024, they also expect a strong recovery in 2025 & 2026 with 11% and 8% EPS growth respectively. At it’s current price, CVS has a forward PE of 8.41, a dividend yield of 3.81%, and a 3 yr PEGY ratio of 0.96x conservatively. I believe CVS is a strong buy. At a 10.68x PE in 2026, CVS offers a 19.84% Ann RoR. Gravity is highly favorable for CVS!

I tend to keep a long list of companies I’m interested in or want to invest in, so these are just a few that I’m currently investing in and/or watching closely. Ideally, we’ll see a bigger correction so the bargains grow! Fear is always a wonderful gift from the markets - it’s just not obvious til much later.

Good luck investing!

PS Not financial advice.