Hershey: A Potentially Compelling Compounder

Hi everyone! Thanks again for reading.

The format of the newsletter is changing moving forward - In this newsletter, I plan to share at least 1-2 emails a month that help you identify potential high quality investments. Please note, most of my articles are not diving into deep due diligence and they are not meant to be financial advice, however, they are investments and/or ideas that I find compelling and may invest in.

Let’s jump into it!

I’ve had my eyes on Hershey (HSY) for about 7 months at this point.

(Very) Basic Company Info

Most of us know Hershey’s for one of the Hershey’s candies like Kisses. Today, they own a number of brands today that includes Skinny Pop, Pirate's Booty, ONE Protein Bars, Dot's Pretzels, Reese's, Twizzlers, and more. Hershey is considered to have a strong business moat due to consumer loyalty and preferences towards Hershey’s products & brand name.

Learn More: Feb 20 2024 Investor Presentation

Initial Screening

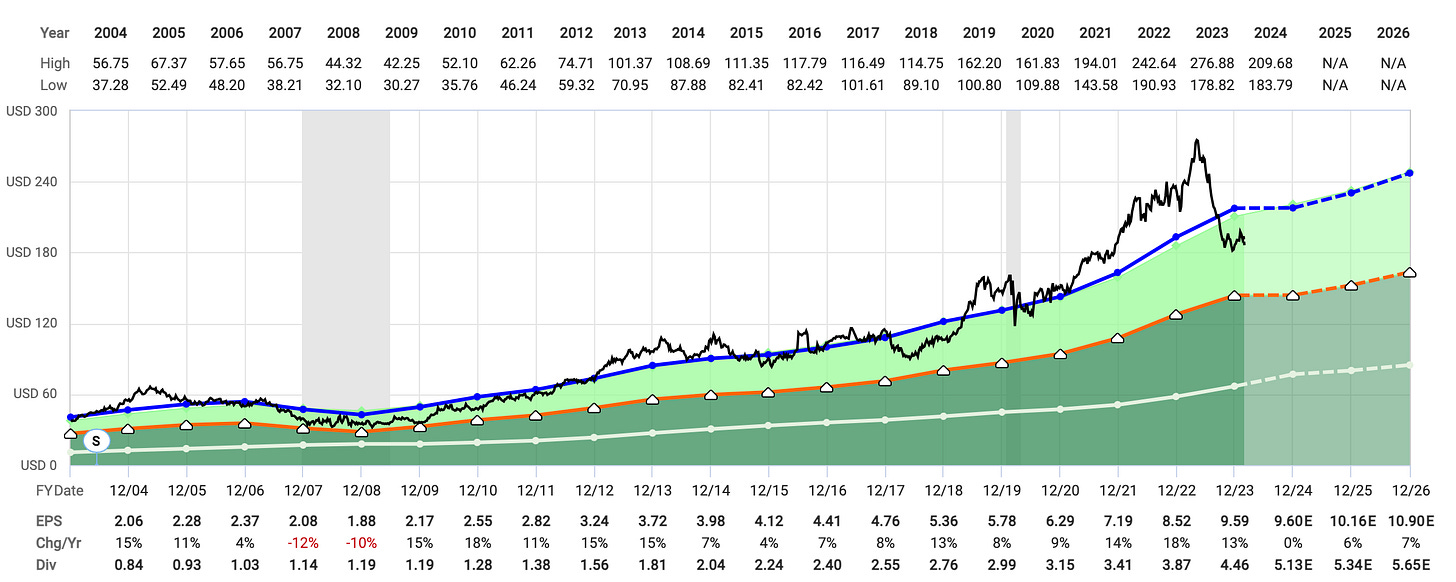

HSY has been a long term compounder, as can be seen here:

Outside of GFC, earnings have generally consistently grown along with the dividends & share price. Since January 2004 (up til Feb 28th, 2024), HSY has generated an annual rate of return of 9.27% a year vs. 8.58% a year for SPY.

If you had invested $10,000 into HSY at $38.27 a share on January 2nd, 2004, you would have generated a total return of $59,685.39.

If you had invested $10,000 into SPY at $111.23 a share on January 2nd, 2004, you would have generated a total return of $52,541.02.

Price to Earnings Ratio

HSY has generally commanded a premium P/E in the market, which is not unusual for such a high quality, stable company.

Over the last 20+ years, Hershey's has gravitated towards a P/E ratio of approximately 22.69x. Again, this is not cheap.

At it's lowest point, HSY has traded at a PE ratio as low as 16.34x in 2010 after 2 years of negative EPS growth.

At it’s highest point, HSY has traded at a PE ratio as high as 30.98x in May 2023.

As of February 29th, 2024, HSY currently trades at a 19.41x PE ratio, or approximately a 14.46% discount to it’s historical fair value. That’s a relatively small margin of safety, but a potentially interesting entry point. Given the [rarely seen] stickiness of the historical P/E ratio, there is some safety around the 16x PE ($155/share) level as a bottom assuming continued operational excellence.

Free Cash Flow

“Revenue is vanity, profit is sanity, but cash is king.”

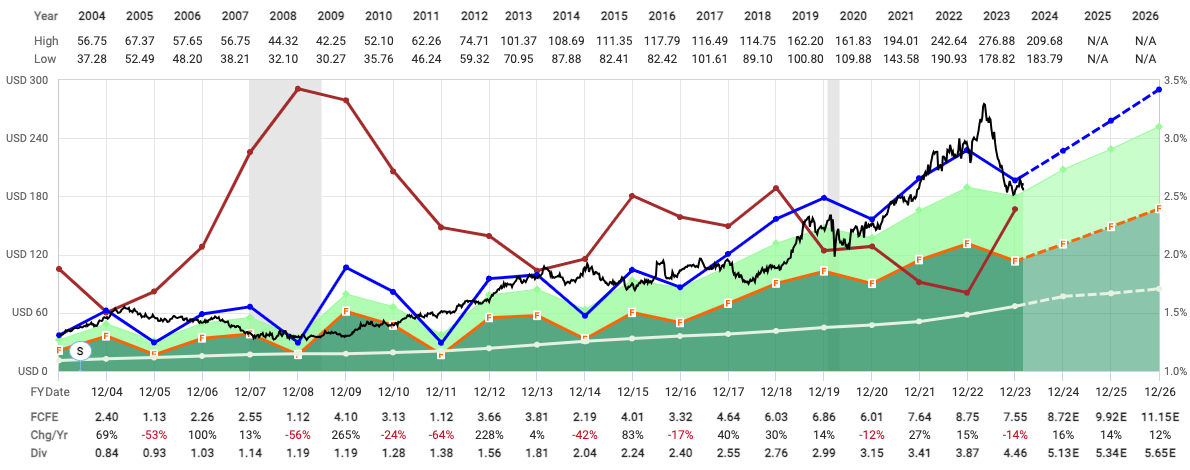

HSY' has typically not traded tightly with it’s Free Cash Flow (FCF) though it remains an important metric I look at for any investment. The forward FCF is 21.354x with an expected growth rate of 16%, 14%, and 12% in 2024, 2025, and 2026 respectively.

20 year FCF chart:

PEGY Ratio

Recently, I’ve been using the PEGY ratio to analyze dividend stocks relative to growth stocks as an additional signal. To learn more about the PEGY ratio, please click here.

As of February 29th, 2024, HSY has a 3 year forward PEGY ratio of 2.67x which is quite high and suggest a hold. If we consider 2022, 2023, 2024 expected, 2025 expected, and 2026 expected, the PEGY ratio is 1.65x which suggest a moderate buy. If we consider the midpoint (7%) of adj. EPS growth long term, the PEGY ratio is 1.95x which suggest a moderate buy to hold.

Overall, the margin of safety on HSY today remains relatively small when evaluated by it’s PEGY ratio. When considering both the P/E & PEGY ratio, HSY is very close to fair value.

Dividends

As of February 29, 2024, HSY has a dividend yield of 2.93%.

Since 2004, HSY’s compound dividend growth rate has been 9.52%. If you had invested in HSY in Jan 2004 and reinvested all dividends, your current Yield on Cost (YoC) is 18.17%.

The dividend payout ratio (based on EPS) has fluctuated between as low as 40.53% (2004) and as high as 54.47% (2016). Currently, the payout ratio is a safe 46.47%.

HSY has also had 15 years of dividend growth after a pause in 2009. On February 8th, 2024, Hershey raised the quarterly dividend by 15% a share. The recent significant raise reflects management’s internal optimism, which I consider an overall positive.

ROC / ROE / ROIC / WACC

According to GuruFocus:

HSY has a Return on Capital (ROC) of 60.64%, or better than 92.67% companies in the Consumer Packaged Goods industry.

HSY's Return on Equity (ROE) is 34.62%, or better than 96.61% of companies in the CPG industry.

HSY's Return on Invested Capital (ROIC) is 20.29%, or better than the 4.7% industry average.

HSY’s Weighted Average Cost of Capital (WACC) is 5.51%.

Given the 14.78% spread between ROIC and WACCC, HSY generates a higher return on investment than it costs the company to raise the capital need for that investment.

These speak, in part, to the operational excellence that HSY has experienced and why it likely commands a premium in the market.

Debt

Long term debt/capital currently sits at a healthy 44.08%.

HSY also has an S&P Credit Rating A with a stable outlook.

As of Dec 31 2023, HSY’s debt to equity ratio is 0.92, down from a short term peak of 3.06 in June 2018. This is mostly thanks to a significant increase in shareholder’s equity, whereas long term debt has increased from $3.25B to $3.79B between June 2018 and Dec 31 2023. The current debt to equity ratio is the lowest it’s been since 2009.

HSY does use a lot of debt (more than 84% of CPG companies) and we are in a normalizing interest rates environment, so more work needs to be done on my side to understand debt maturities and how it may impact earnings over time.

Future Expectations

According to analysts, HSY is expected to deliver 0% EPS growth in 2024, 6% in 2025, and 7% in 2026.

According to HSY management, they expect 2-4% net sales growth and 6-8% adjusted EPS growth long term. It’s worth noting that HSY achieved 10% average adjusted EPS growth over the last 10 years.

From my understanding thus far, the stagnant EPS growth in 2024 is driven by consumers pushing back on food cost inflation along with cacao prices sky rocketing.

Current Stand Out Risks

Cacao prices are rapidly skyrocketing and currently near all time highs:

HSY’s products generally contain ~11% cacao so 2024 EPS has been adjusted lower, in part, to reflect rising input costs. As of February 20th, 2024, HSY’s management has reaffirmed it’s guidance for 2024.

That said, if cacao prices continue to rapidly rise, EPS may be more deeply impacted.

In 2024, HSY and many CPG companies continue to see consumers push back on food cost inflation. According to Truflation, food inflation in the last quarter has been sub 1% in Q4 2023. If food inflation turns into deflation, EPS may be more deeply impacted.

In addition, many CPG companies like HSY have been faced negative sentiment around Ozempic, the weight loss drug. While Ozempic is a threat to HSY and should not be ignored, I believe the risks at this stage may be overblown.

Conclusion

It’s important to note that HSY is a departure from my deep value investing style towards growth at a reasonable price (GARP). When focused on deep value, I tend to look for historically very cheap shares in a company relative to its history. For example, META near the 2018, 2020, and 2022 lows was a clear deep value investment as it met my criteria for a significant undervaluation combined with my own long term belief in the company. I try & avoid deep value companies that are just based on a low P/E or high dividend as most [though not all] of those are traps and low quality businesses. It’s rare that wonderful companies go on such a deep sale, but I am always hopeful to acquire shares with a deep value, high quality preference in moments of true market panic/more significant market corrections [December 2018, March 2020, and late 2022 stand out in recent years]. I am very interested to see how the differing approaches fare in returns over the coming years, and I’ve constructed 6 different actively managed portfolios each with their own somewhat varied strategy (including an ETF only portfolio) to continue to refine my approach.

HSY has corrected from significant overvaluation in May 2023 to slight undervaluation to fair valuation as of February 29th, 2024. While HSY commands an expensive premium in the markets, I believe the current price ($187.12) is a compelling entry point in my own portfolio. Given that, I have initiated a few purchases of HSY, and I’m interested to see how HSY plays out over the long term. If the current thesis behind the company changes in any [long term & thesis-breaking] way, I will sell and move on.

In addition, I sell cash-secured puts from time to time on investments I’d like to own at prices below the current share price. I do sell some puts on HSY around $155-$165 often 60-90 days out to collect a small premium in addition to the return on capital in floating rate Treasuries today. This allows me to achieve a 5.2% yield on cash I’m waiting to deploy + 2-3% yield on options premiums on companies I’d like to own, and I get “paid to wait”. There are significant risks to any options strategy [regardless of how safe it may seem], and I deploy it very, very carefully and with very minimal risk in the context of my total portfolio.

PS, not financial advice.