Interesting Stocks/Sectors in Early 2024

Hi everyone! Thanks again for reading.

For those that are new to my newsletter - In this newsletter, I plan to share parts of my exploration into the world of economics and finance to make sense of what are often incredibly complex and opaque mechanisms. I will do my best to keep it as simple as possible, so it can be broadly understood without a finance/economic background ideally. Given that, please keep in mind this is as simplified as possible purposefully.

It's been 2+ months since my last post. As always, I remain a consistent investor in all markets.

A few of my articles over the last 2 years have been timely, but this is one of the most noteworthy:

When tech companies are cheaper than value companies...

Hi everyone! Thanks again for reading. For those that are new to my newsletter - In this newsletter, I plan to share parts of my exploration into the world of economics and finance to make sense of what are often incredibly complex and opaque mechanisms. I will do my best to keep it as simple as possible, so it can be broadly understood without a finance…

As an investor, I’ve found my place in this world:

I invest generally in whatever is most hated at a particular point in time.

Valuation is everything, period. I will not over pay if I can help it.

I’m willing to pay near fair value for the right, wonderful company.

I am not afraid to manage a significant number of holdings (with enough automation to make it easy) - concentration is not a deep part of my strategy today though I test many strategies concurrently to refine my approach over time. Given that, I may concentrate in the future, or not.

In 2020/2021, I was investing very defensively as a reminder. That meant cheaper consumer staples, REITs, energy, financials, and other “real world” companies. Most of these investments have done very well over this period of time. Even the REITs that have now taken a beating have generated a nice annualized return for me in aggregate thanks to the low starting valuation.

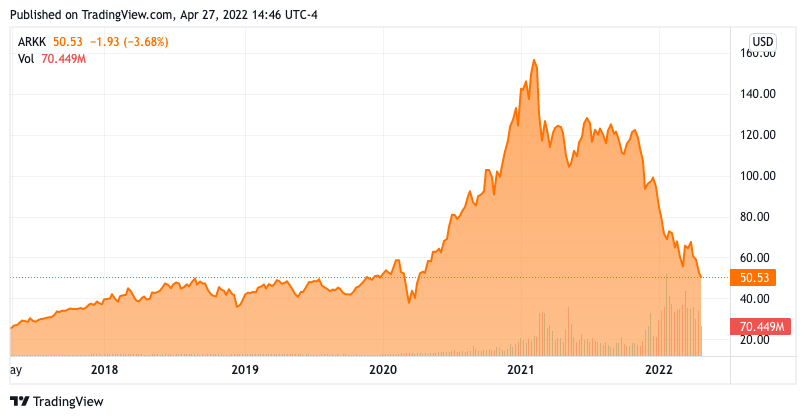

In late 2022/early 2023, I was investing mostly in growth companies. Shopify, Facebook, Wise PLC, Google, Amazon, Netflix, Paypal (one of my few losers), MercadoLibre, Adobe, Salesforce, etc. All of these companies hit incredible valuations.

In early to mid 2023, I shifted towards regional banks (post SVB crisis) with a serious focus on valuation/quality (and the likelihood they would not go bankrupt!!!). Fifth Third Bank, Truist, TD Bank, State Street Corp. I think the regionals are still playing out, but my annualized performance is 14.19% thus far on these names. Thus far, still outperforming SPY on the same metric.

In mid to late 2023, I shifted towards REITs, health insurers, consumer staples, and some high quality names. Many high quality names became cheap, particularly around October 2023 market lows. United Healthcare, Elevance Health, Alexandria REIT, Realty Income, Camden Property Trust, Mid American Apartments, Hersheys, etc. These are still in the early stages of playing out. While some of them have caught a bid (UNH + 16% since purchase or roughly 20%+ annualized thus far), I’m really not expecting these to perform til 2025.

In early 2024, markets are back at ATH and valuations in most tech companies are not all that enticing. That said, I am still focused on quality companies with a particular focus on PEG(Y) ratios at this time.

Given that, here are some sectors that are interesting to me now and some names within them:

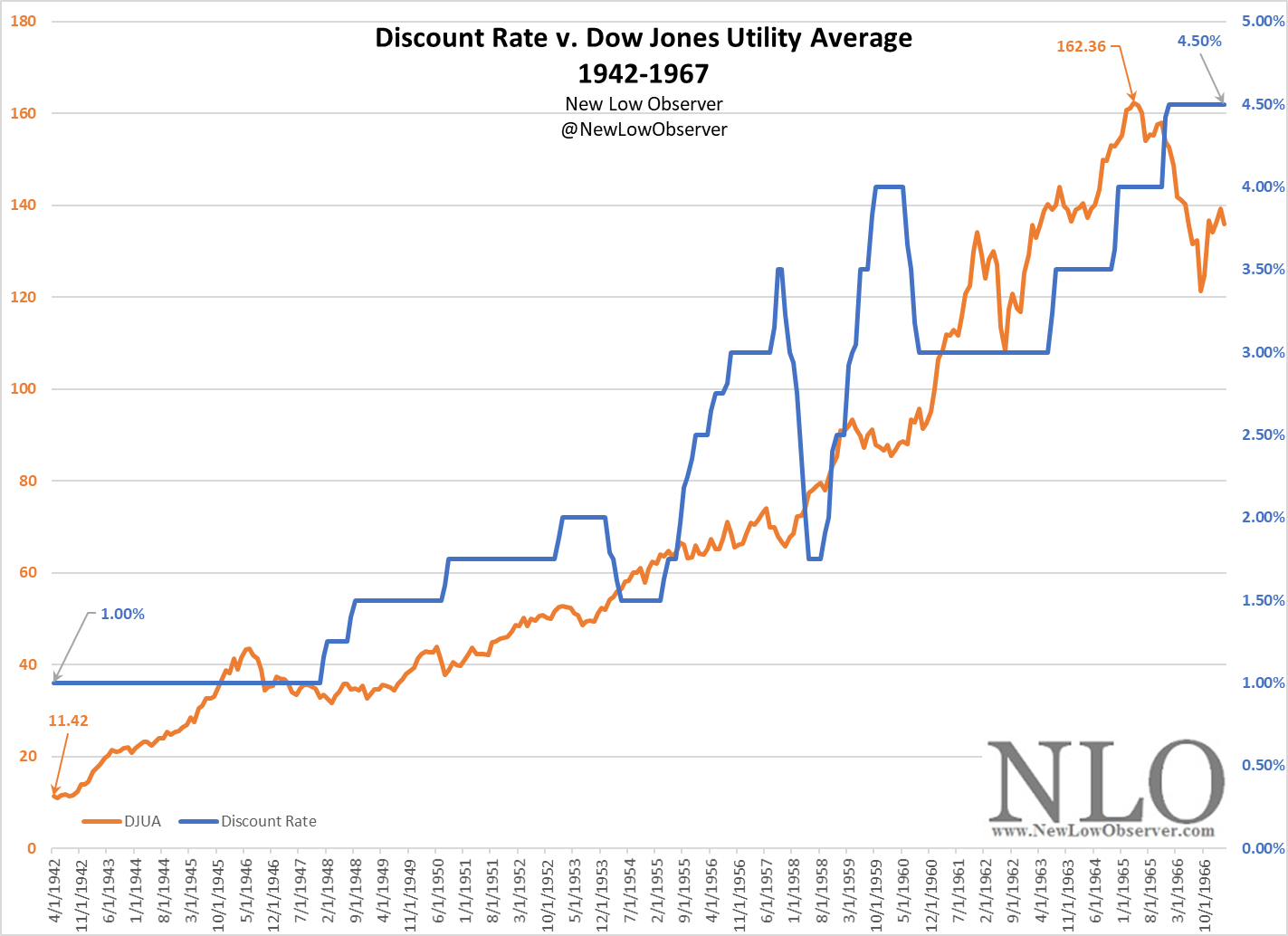

Utilities - Utilities are beaten down today and they were quite expensive not long ago. They have not been on my radar for years, but recent prices have become pretty enticing. I understand investors see this as a proxy for interest rates and to some extent, that is true. However, history also shows utilities do climb with higher/rising rates:

Some interesting names at this time:

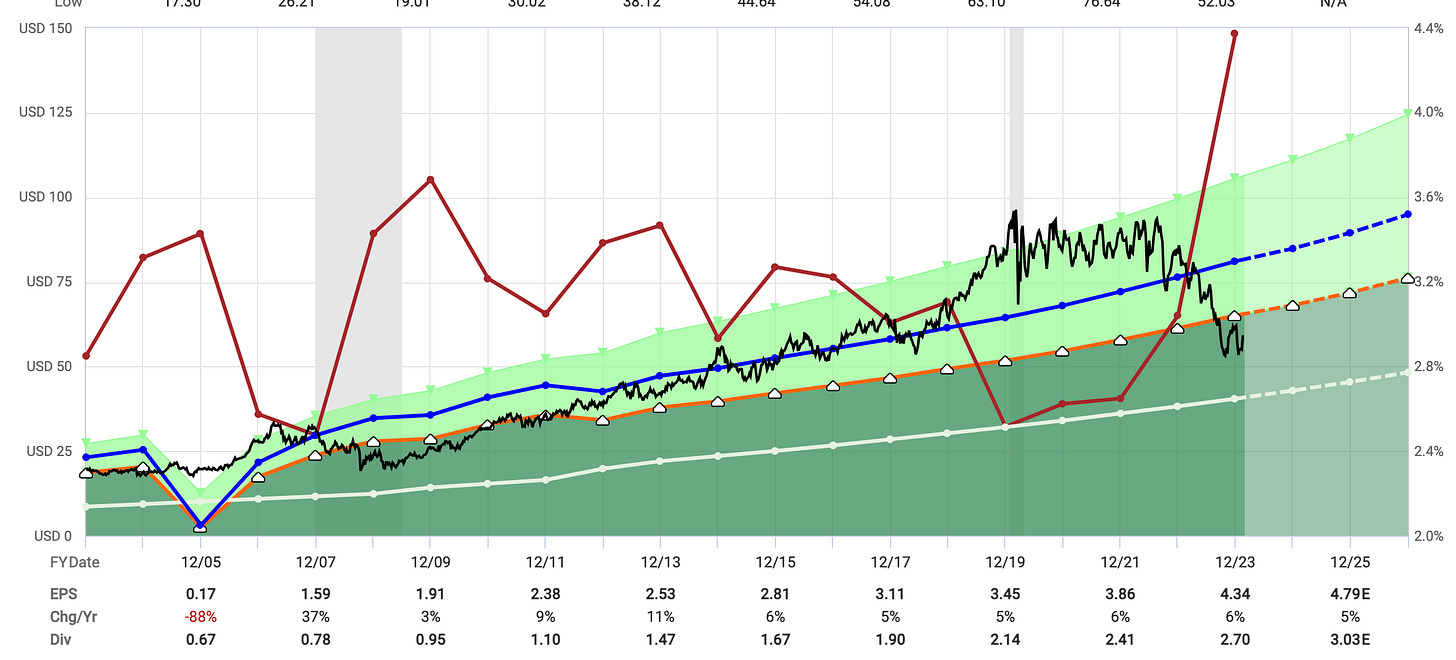

Next Era Energy Partners (NEE): Relative to the last 10 years, NEE is undervalued. NEE has a dividend yield of 3.61%, a potential discount to fair value of 29%, a payout ratio of 61%, an A- credit rating, 28 year dividend growth streak, 49% debt/capital, an earnings yield of 5.61%, a PEGY of 1.65x, and an expected dividend growth rate of 10% through 2026. The PEGY rates this only a moderate buy, but I am interested in it because of the quality of the company.

Eversource (ES): Relative to the last 24+ years, ES is undervalued. ES has a dividend yield of 5%, a potential discount to fair value of 36%, a payout ratio of 63%, an A- credit rating, 24 year dividend growth streak, 54% debt/capital, an earnings yield of 7.48%, and a PEGY of 1.27x. Dividend growth is expected, though likely mid single digits. The PEGY rates this a strong buy.

Tech - Tech is mostly expensive today, but to be frank, there is a reason why. As rates have gone up, the best companies have outperformed proving out their moat. Many of these companies are simply cash flow machines at this time. I am selectively willing to purchase some tech companies at this time as a result.

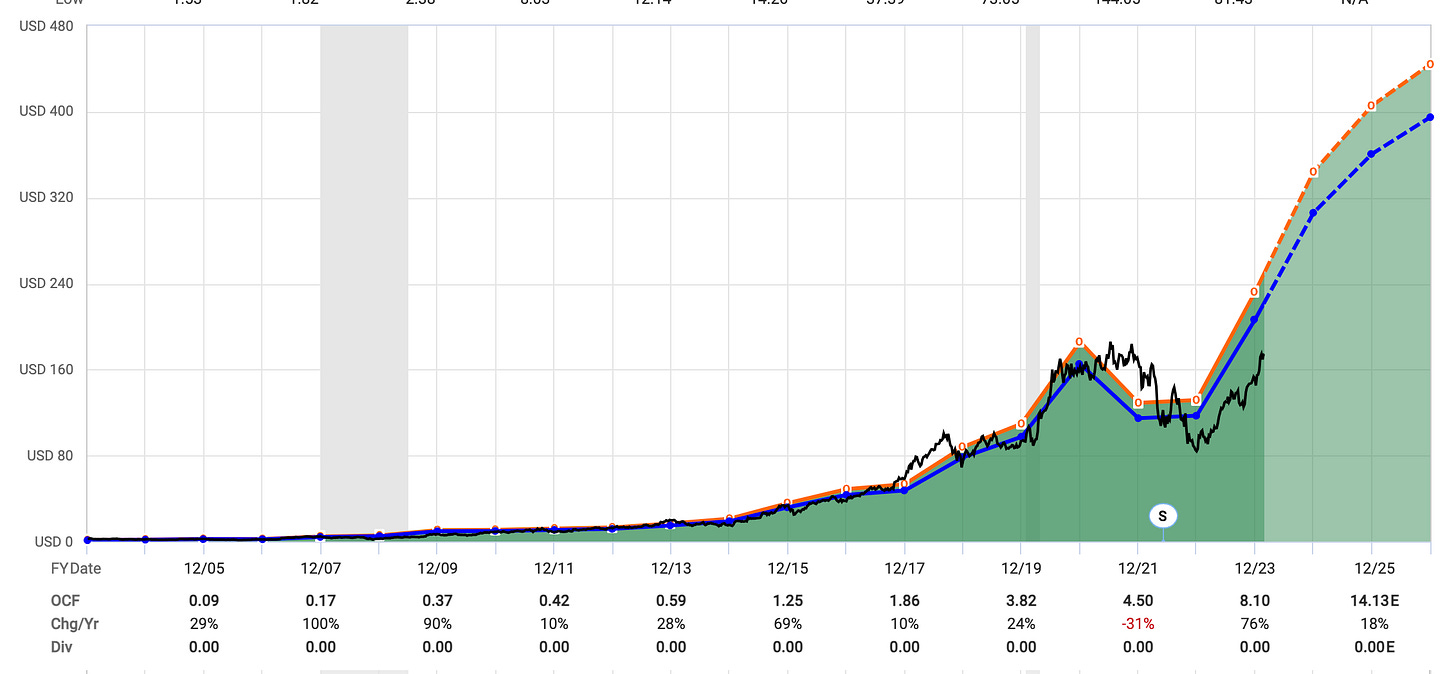

Amazon (AMZN): I believe Amazon remains one of the few undervalued tech companies poised for continued significant growth. AMZN has historically been valued on it’s Operating Cash Flows and is now also showing a focus on EPS & FFO. On a forward OCF basis, AMZN is valued at 14.59x or at a fairly significant (40%+) discount relative to its history. On a forward FFO basis, AMZN is valued at 27.13. Arguably cheap/FV for a company growing FFO at 19% average the next 3 years. On a forward EPS basis, AMZN is valued at 42.58x. This is not cheap, though EPS is expected to grow 34% on average through 2026. The PEG ratio is 1.25x on PE, 0.78x on OCF, and 1.43x on FCF. Overall, all 3 metrics are pretty encouraging and suggest anywhere from slight overvaluation to deep undervaluation for a fabulous business. I would not be surprised if Amazon initiates a dividend in the next few years.

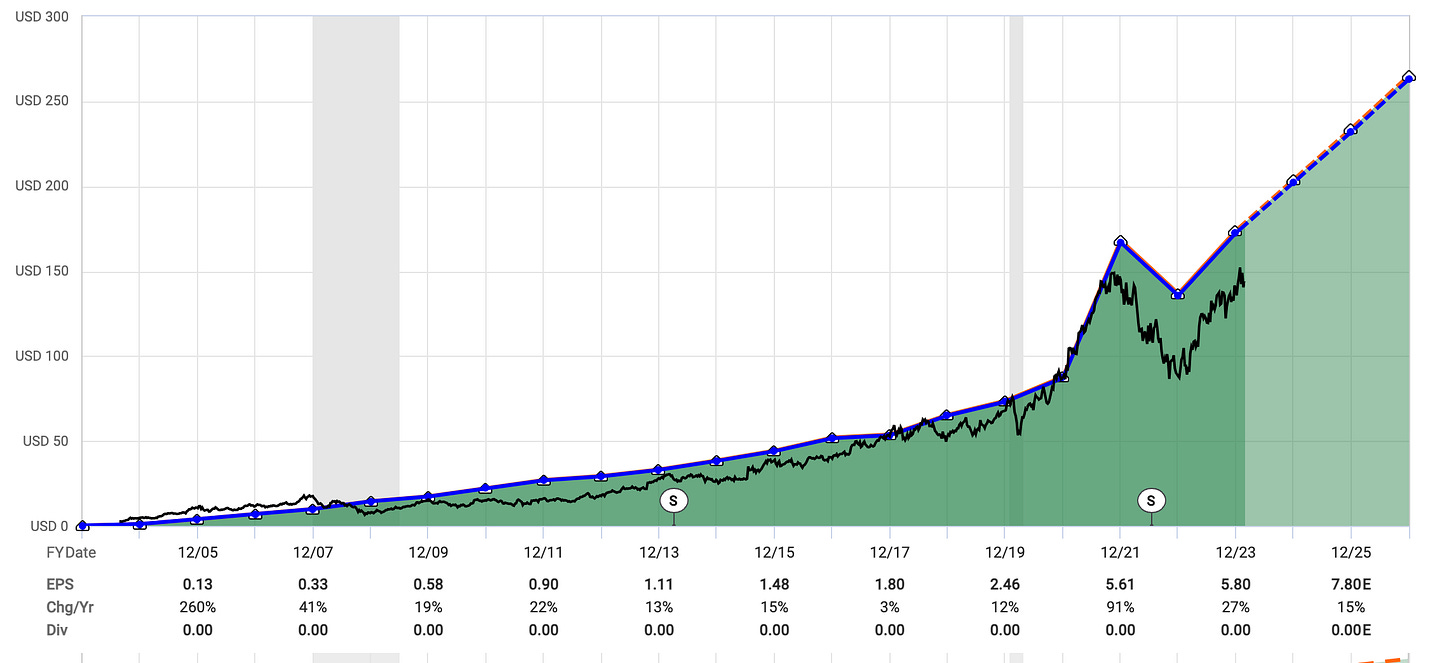

Google (GOOGL): The digital ad market has been tough the last 2 years. There has been a serious flight to quality with serious winners & mega losers. GOOGL has been a clear winner. On a forward PE basis, Google is valued at 21.28x, roughly in line with it’s historical value over the last 15+ years. The PEG ratio is 1.69x based on expected forward 3 year earnings, rating it a moderate buy. Debt is ultra low at 8.21%. Overall, an enticing near fair market purchase that is likely to continue to compound regardless of sentiment around search, AI, gemini, etc. I would not be surprised if Google initiates a dividend in the next few years.

Real Estate - REITs did catch a bid in October 2023, though some have managed to get cheaper again this year. REITs do face challenges since we’re exiting a ZIRP environment and in a more normalized interest rate environment.

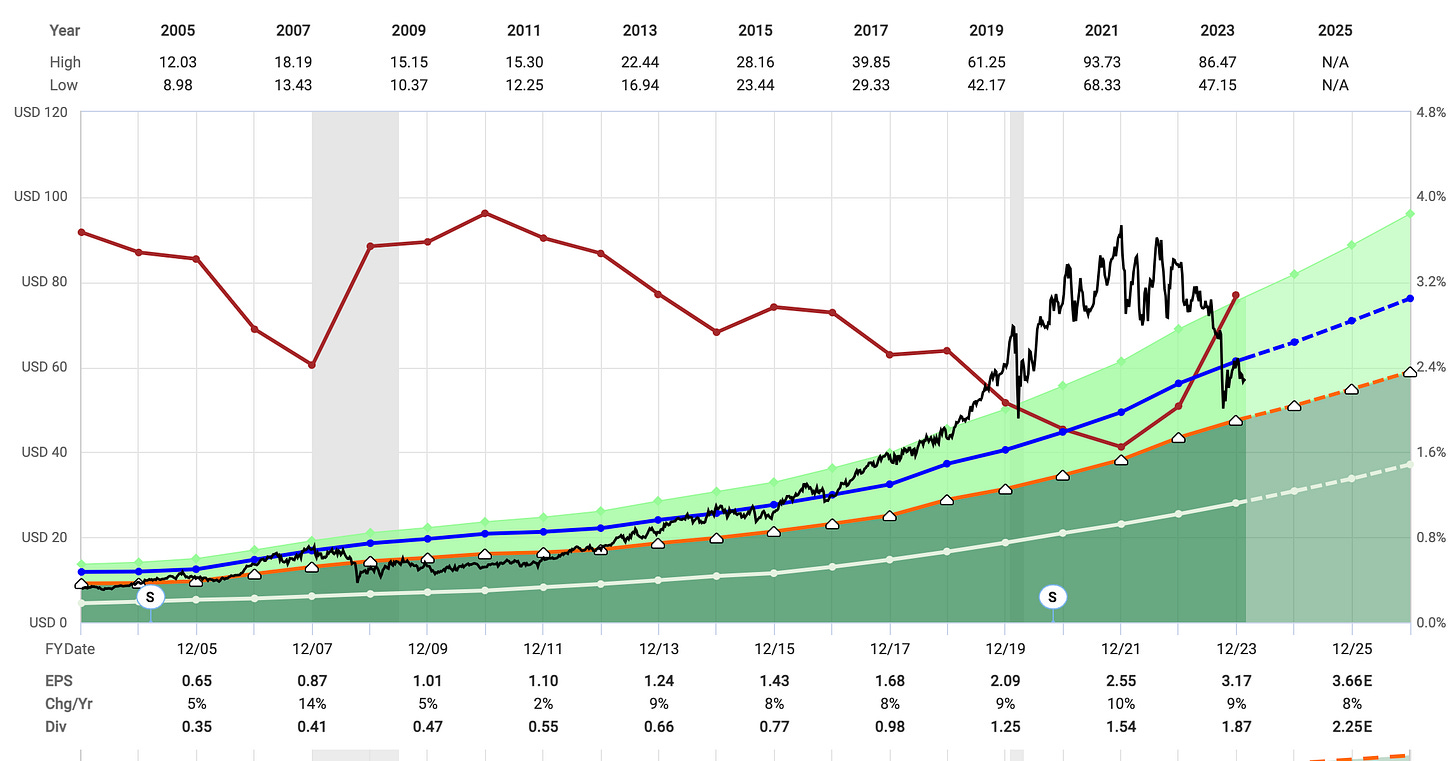

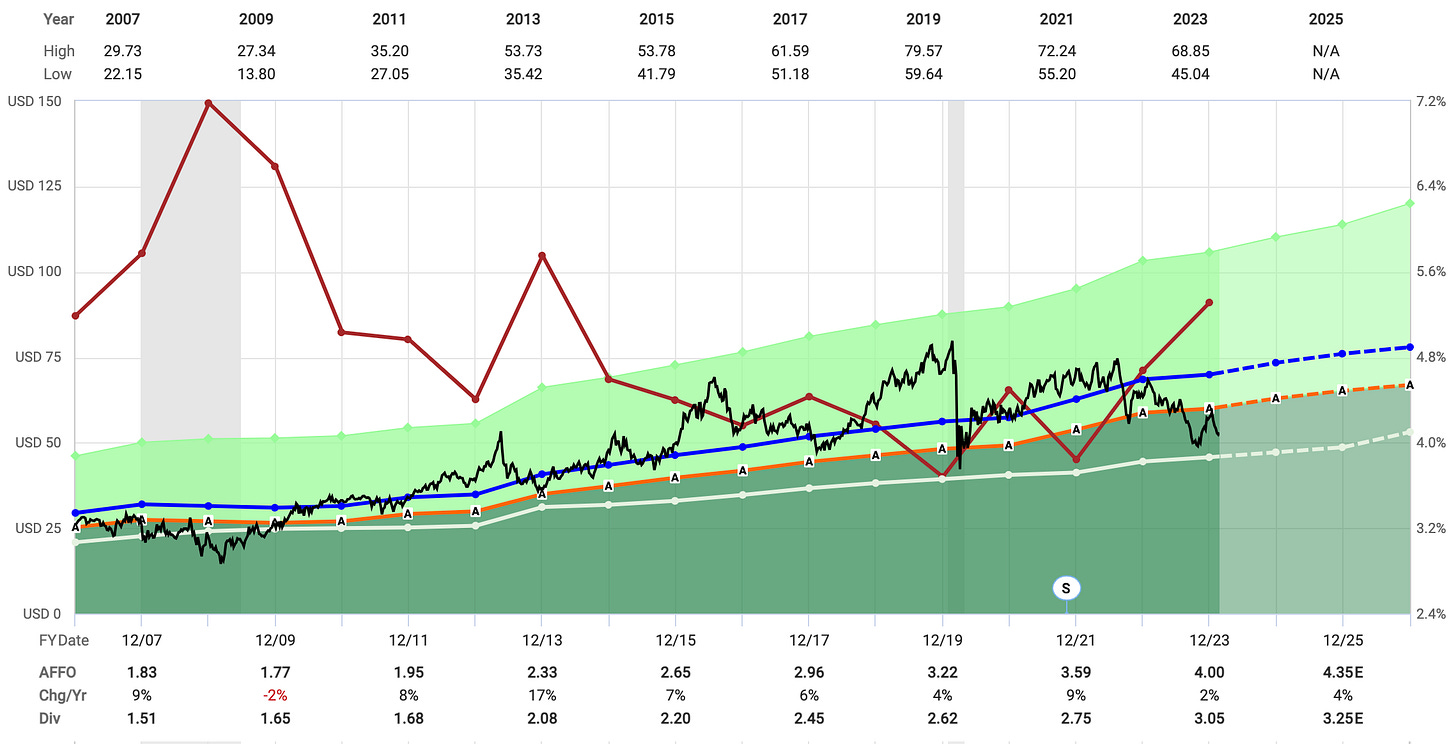

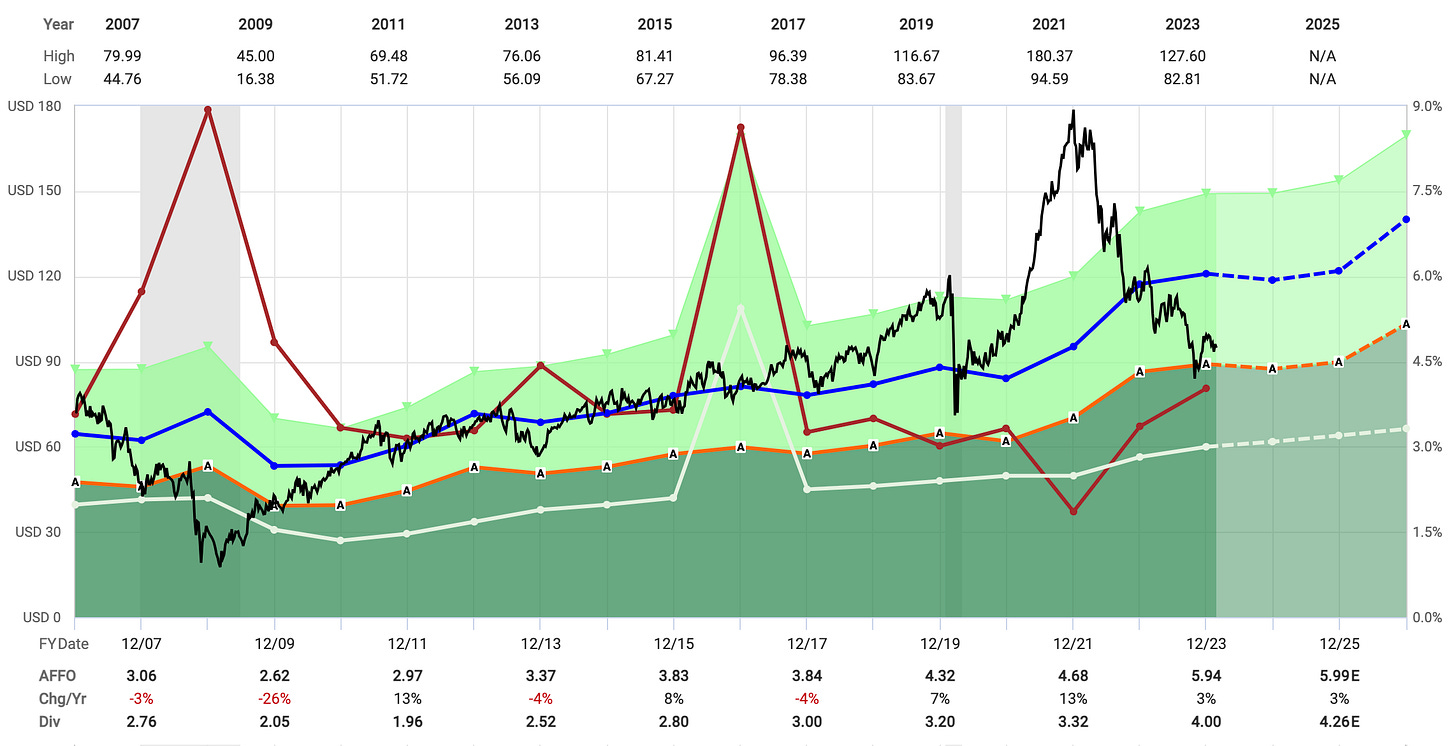

Realty Income (O): This is the one of the largest and most successful REITs in the world. With an AFFO yield of 7.66%, a payout ratio of 75%, a 31% potential discount to fair value, a 5.80% dividend yield, a 12.41x forward P/AFFO, 40% Debt/Capital, an A- credit rating, and a 1.25x P/AFFO/GY, I am happy to buy at these prices.

Camden Property Trust (CPT): Camden is a multi-family REIT trading a historically cheap P/AFFO. It has an AFFO yield of 6.25%, a 4.34% dividend yield, an A- credit rating, a forward P/FFO of 13.99, and a P/AFFO/GY ratio of 1.66x. Camden is a moderate buy. Though it may be a difficult 2024, much of that is already priced in at these levels.

I have a running list of interesting companies at all times, these are just a few that are interesting me today with some surface level metrics that establish just an initial screener for continuing with due diligence. These companies may get cheaper yet (we can only hope!), or they may not. Markets are expensive again today, but these companies remain relatively cheap and also high quality.

Want me to dive deeper into any of these companies or share information differently? Share some feedback, I’m hoping to start writing more regularly again!

PS Not financial advice.