Lower Rates Are Not A Savior

Hi everyone! Thanks again for reading.

In this newsletter, I plan to share at least 1-2 emails a month that help you identify potential high quality investments. Please note, most of my articles are not diving into deep due diligence and they are not meant to be financial advice, however, they are investments and/or ideas that I find compelling and may invest in.

Let’s jump in!

Real quick - markets are back near all time highs, though there has been A LOT of single stock volatility with large drops & gains in individual stocks. Most of the large drops are either due to unexpectedly poor earnings (blamed on macroeconomic pressures) or strong earnings combined with lower future guidance. Most of the large gains are due to strong earnings along with reaffirmed or strong future guidance. This pattern is playing out across sectors and companies within them, so there is some clear macroeconomic factors at play even though execution ultimately matters most. For now, keeping an eye on opportunities!

Moving on, we’re still living in a world where most individuals and companies are hopeful that low rates will come back and higher rates are simply a fluke.

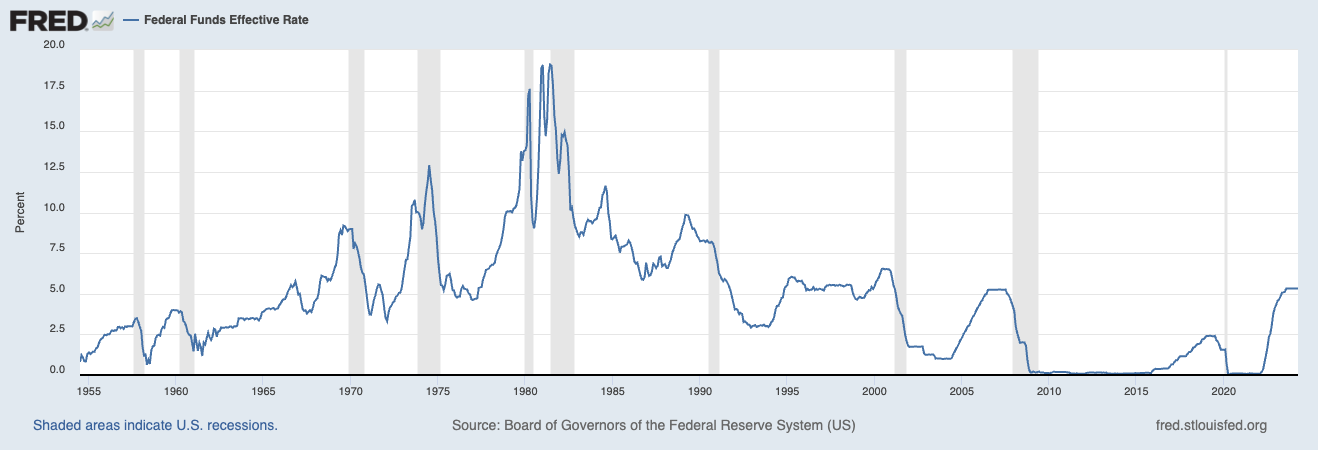

The US has had many secular falling rates and rising rates cycles. The last secular falling rates lasted from 1980 to 2022 (imo), so many of us are simply used to lower rates and those of us who grew up in the aftermath of GFC don’t know a thing about normal interest.

Charles H Dow (who founded WSJ and Dow Jones) noted on July 24, 1899:

“Interest has been so low for so long a time that to many people a rising rate produces a sort of alarm, and it is natural to expect a considerable lapse of time before this will disappear under the new conditions.

Prosperity, a higher interest rate, and a boom in the stock market have seemed to be impossibilities, and yet there is a slow but sure changing of belief in this respect among many, and not a few hold the conviction that this condition is a near possibility.”

While interest rates today may be considered very high by most of us, there is little indication that interest rates will drop anywhere near 0% again without a very dramatic economic collapse.

So, let’s model a few very basic scenarios:

1. Rates drop by 100-150 basis points: In this scenario, we may achieve a soft landing resulting in the kind of pain we’re seeing in the economy today but without a serious recession with very significant job losses. In this case, we may see mortgages even out around 5-6% which is a lot more affordable than the 7%+ we’re seeing today. In addition, we’ll see similar pressure lighten on corporations with debt that needs to be financed. We’ll see similar pressure lighten on SMBs or others with variable rate debt. Markets will likely stay relatively strong or face a more typical correction. Sure, not everyone can survive without very low rates, but that may be the point of a healthier economy with healthy rates. This is a good scenario for the vast majority of people as we may skirt a recession, inflation pressures will remain relatively contained even if somewhat elevated (average inflation rate has historically been 3.5%), incomes will be minimally impaired, and money will be less tight such that many can now proceed with certain financial decisions. People and businesses will adjust. Rates may rise again if inflationary pressures or other excesses build.

2. Rates drop back closer to the zero bound: In this GFC type scenario, we’re undoubtedly in a very serious hard landing scenario where the economy is on life support. So, inflation has turned into disinflation, unemployment is sky rocketing, bankruptcies are skyrocketing, and earnings are likely collapsing in this scenario along with a recessionary drop in markets (30%+ and likely more like 50%). Sure, mortgage rates may drop to 2-4% and other forms of debt will be refinanced at lower rates (potentially), but it’s likely everyone will be worse off. Can you buy a home if your income/net worth is significantly impaired and the future is highly unclear? Most can’t. This is a terrible scenario for the vast majority of people as the recession will impair them financially, but sure, a few will benefit from this.

3. Rates drop by 200-300 basis points: In this scenario, we may have a very mild hard landing with a 2-4 percentage point increase in the unemployment rate, bankruptcies are up, earnings are impaired, there is a 20%+ drop in markets, and excesses are being cleared in a relatively mild (though painful enough) manner. In this case, the cost of debt will be lower for a % of people that are doing okay in a mild recession and simply won’t matter for another % of people that are struggling. This is a moderate scenario because there will be a difference between those who will be seriously impaired and those who won’t be seriously impaired. Importantly, I believe many of those who need very low rates to save them will likely be impaired. The rate drop will set the stage for a new business/investment cycle wherein rates likely rise again gradually.

These are 3 basic scenarios I consider today.

My very basic assumptions:

While I think inflation is at or near the Fed’s objective and don’t buy the stagflation or accelerating inflation narrative, I do believe that any significant drop in rates is not really warranted without a very negative economic outcome that negates the value of those cuts largely. If rates go to 2% just because inflation is down and the economy is good - what is going to stop inflationary pressures from rapidly building? I believe nothing and it would bring about more pain for longer.

Since stagflation/accelerating inflation is hard for me to see today and the Fed itself is not intent on raising rates further, I don’t consider rates rising further from here as a base case for this cycle.

More importantly, I don’t think it’s really possible to predict such a dynamic economy. In reality, there is an endless number of scenarios one can consider and even though we can assign probabilities to the most likely ones, the very unexpected is likely to happen. For that reason, the primary purpose of this exercise is to further establish a basic rule for investing in any asset/company:

Assume normalized rates will persist through time moving forward. By doing so as much as possible, I am not betting on rates moving one or way or another, but rather an asset or investment performing in a particular way due to starting valuation and execution in any interest rate environment. I think it’s easy to get into a lot of trouble if an investment rest on rates inevitably dropping (or doing something) and this doesn’t come to fruition.

Lower rates are not a savior. Markets generally rise in a rising rates market and rapidly lowered rates are nearly always met with painful market/asset valuation corrections. You can see that here more clearly where the Federal Funds Rate is graphed against gray recessionary periods:

PS Not financial advice