Hi everyone! Thanks again for reading.

For those that are new to my newsletter - In this newsletter, I plan to share parts of my exploration into the world of economics and finance to make sense of what are often incredibly complex and opaque mechanisms. I will do my best to keep it as simple as possible, so it can be broadly understood without a finance/economic background ideally. Given that, please keep in mind this is as simplified as possible purposefully.

Let’s jump into it.

As I’ve been noting over the last few months, recession probabilities have been increasing. See below:

As every week and month passes since then, we’ve seen a number of indicators turn. In addition, we’ve seen a flatter yield curve that has inverted in various places which is a significant additional indicator of recession.

Here is just a few this week:

On May 16th, the Empire state manufacturing index fell from a 24.6 reading to -11.6, significantly lower than the 16.5 expected. Any reading below 0 indicates deteriorating conditions. The biggest drop came from new orders.

The Philadelphia Fed manufacturing survey fell sharply today to 2.6 in May from 17.6 in the prior month. The expectation was a reading of 15. This is the lowest level of activity since the pandemic.

The Leading Economic Index fell 0.3% in April. The LEI is a weighted gauge of 10 indicators to show whether the economy is getting better or worse. The forecast was a flat reading, so this is worth monitoring.

The Conference Board Measure of CEO Confidence declined for the fourth consecutive quarter in Q2 2022. The measure is now at 42, levels not seen since the onset of the pandemic. A reading below 50 reflects more negative than positive responses.

More to consider:

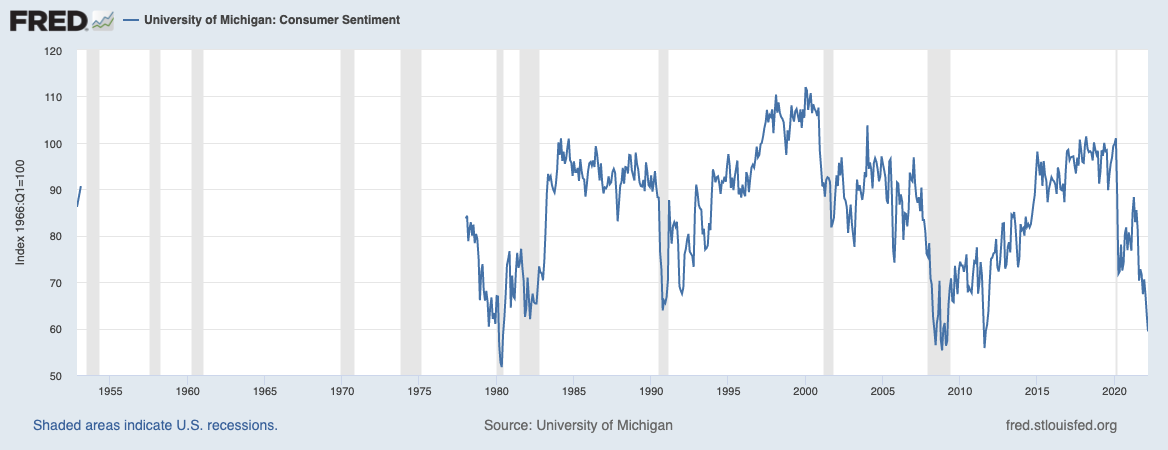

Consumer sentiment is in line with recessionary conditions:

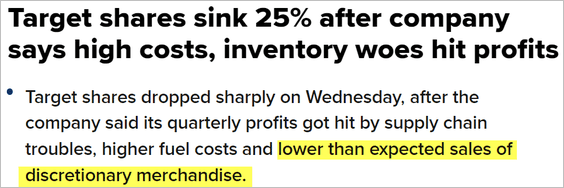

Earnings are also backing up declining expectations:

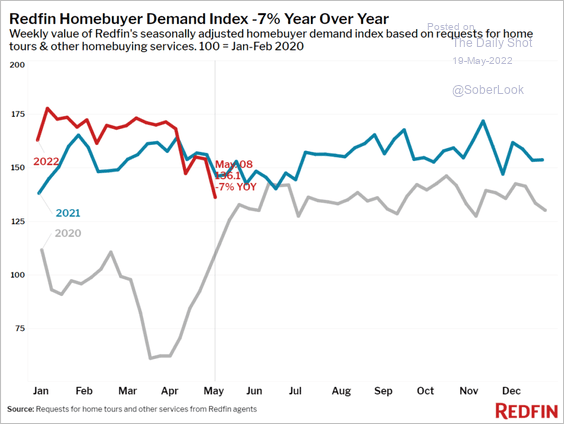

Homebuyer demand is rapidly falling due to the fastest rate of change in mortgage rates in decades (thus deteriorating affordability):

The USD is strengthening to the highest levels since early 2000, this is generally not a great sign especially as the USD tends to get stronger in any global crisis (due to high demand for dollars yet a shortage of dollars):

Nearly anywhere you look globally, economic conditions are rapidly deteriorating. The US has managed to remain relatively strong, though a global recession in 2023 looks increasingly likely.

If the Fed continues to aggressively hike rates to moderate inflation, I believe they will get a lot more than they bargained for. As I noted in my article We avoided a Great Depression in 2008, but did we really?, there is 2 paths IMO:

1) Extremely painful deflation similar to the Great Depression. Imagine your asset values declining an easy 90% and taking decades to recover - likely in this scenario. This would mean allowing lots and lots and lots of bankruptcies.

2) Inflate the debt away by devaluing the currency. This is the easier pick, it creates significant issues on its own, but staves off the extreme deflationary pain if it works.

And, I continue to believe #2 is the only feasible option in most developed countries that have this luxury due to strong (or perceived strong) currencies.

This past week, the Fed Reserve Chair Jerome Powell was interviewed by Nick Timiraos. Jerome Powell made his stance clear: The Federal Reserve has only one objective in mind: meaningfully controlling inflation regardless of the consequences.

The time for rate hikes was a year ago. Hiking rates into a declining economy is a recipe for disaster typically. Given this, I do believe as the economic indicators continue to deteriorate and inflation likely shows signs of moderations, the Fed is likely to pause rate hikes at ~2% in July or August 2022. However, I don’t believe they will cut rates to 0% given the inflationary backdrop, and I do believe 0% rates are inappropriate. If inflation stays elevated at 3-4% with rates at 2%, then we’ll still slowly inflate debt away and devalue the currency. And, lots of people will have learned lessons on speculation thus a repeat speculative fervor is unlikely which is a positive for future financial conditions.

Bottom Line: I do believe we’ll go into an inflationary recession if one comes to pass. It’s something we have not experienced for a few decades, but it has happened before. At this point, inflation can only be solved ultimately by solving supply issues rather than crushing demand (though crushing demand may help in the short term in alleviating some issues around supply chains). For example, we need to incentivize US oil & gas companies to drill and provide them capital to do so, yet we’re unwilling to do so. Instead, we get caught up in political narratives when it’s simply a math equation that reveals we have way more demand than supply. As always and with all of this said, I remain a realistic optimist and great believer in our collective future prosperity. But first, pain.