Recession Triggered?

Hi everyone! Thanks again for reading.

In this newsletter, I plan to share at least 1-2 emails a month that help you identify potential high quality investments. Please note, most of my articles are not diving into deep due diligence and they are not meant to be financial advice, however, they are investments and/or ideas that I find compelling and may invest in.

Let’s jump in!

This morning, the unemployment rate was reported at 4.3% vs. 4.1% expected. In addition, employers added 114,000 jobs in July vs. 185,000 expected. So, there is a clear & material slowdown in the jobs market beyond expectations.

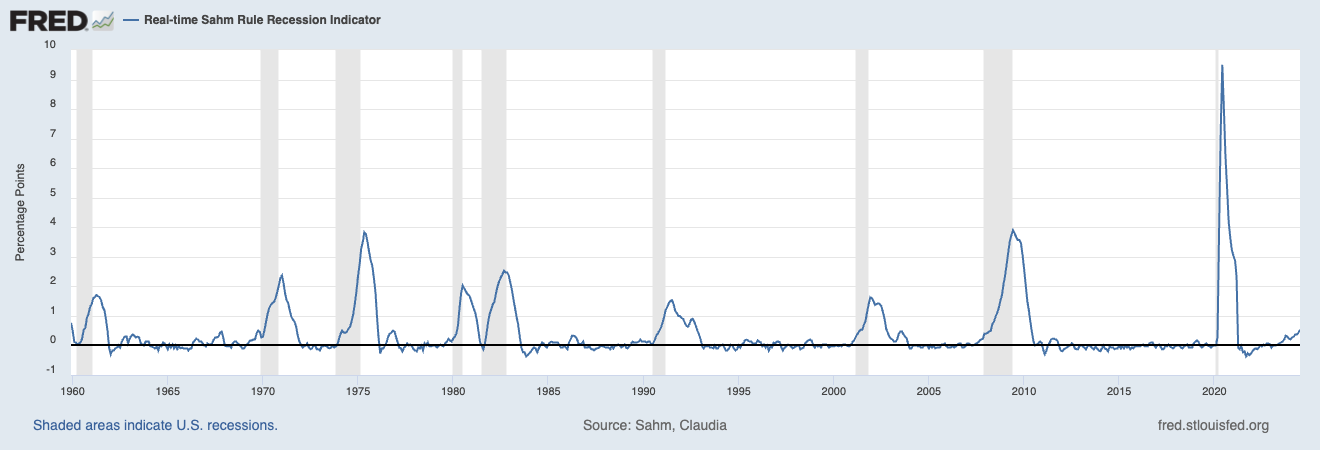

With this report, the Sahm Rule triggered a recession may already be underway. What is the Sahm Rule? Simply put, the Sahm Rule takes the three-month average unemployment rate and compares it against the lowest three-month moving average unemployment rate over the last 12 months. If there is an increase of a half a percentage or more (0.53 as of today), then a recession is historically underway.

Dr., Claudia Sahm cautions "The Sahm rule is an empirical regularity. It’s not a proposition; it’s not a law of nature." With the sheer number of pandemic-related distortions, there is a question as to the accuracy of this indicator. If the Sahm Rule is incorrect, this will be the first time since 1960 that the indicator fails us.

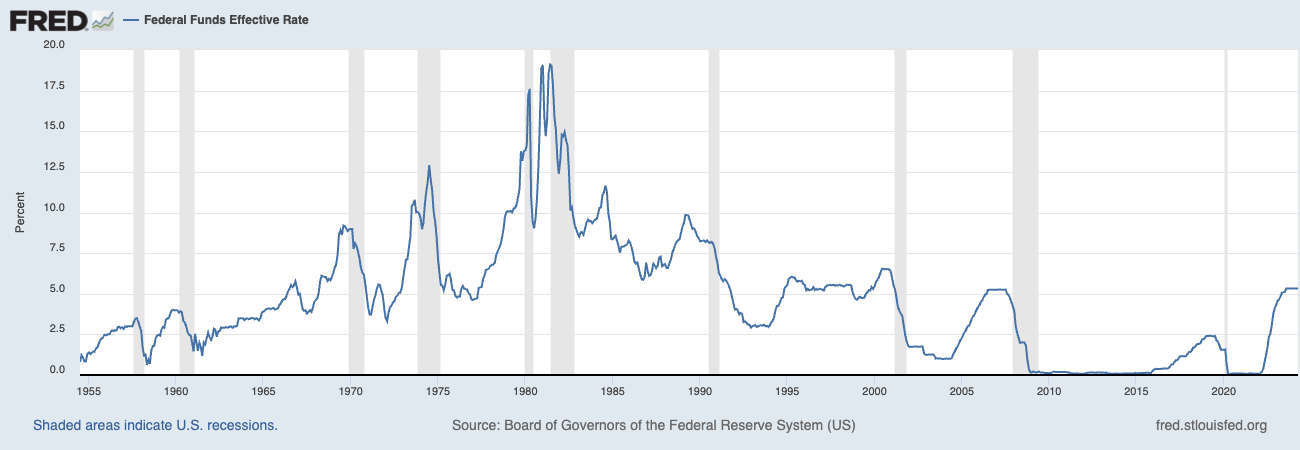

Quick note, the Federal Reserve also left rates unchanged on Wednesday with an expectation to cut 25 basis points in September. During Powell’s presser, he also said that the Sahm Rule was a “statistical regularity, it’s not like a economic rule where it’s telling you something must happen.” Given his commentary, I personally assumed the Sahm Rule would trigger today.

So, let’s look beyond the Sahm Rule.

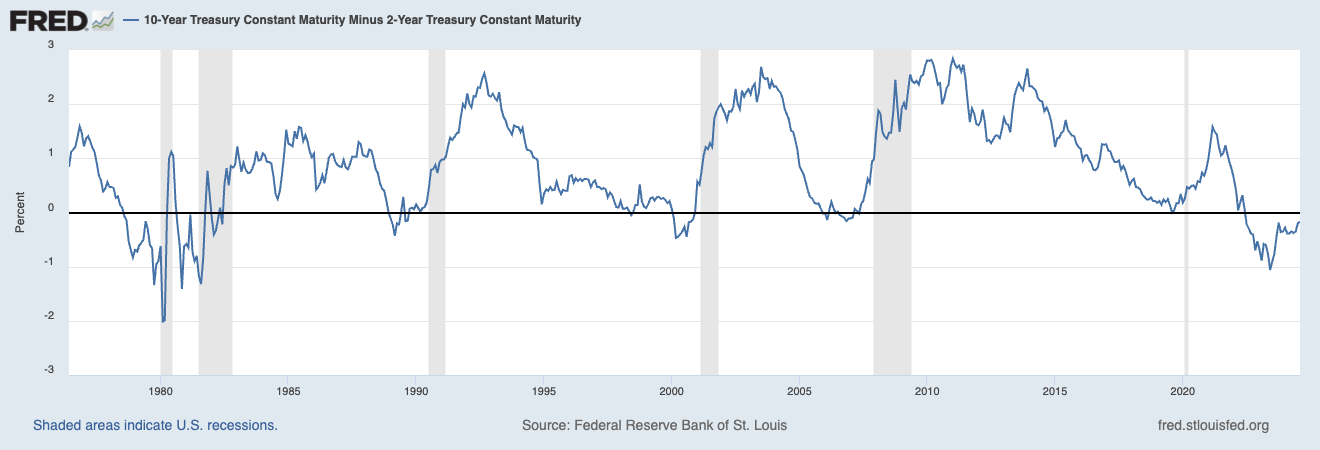

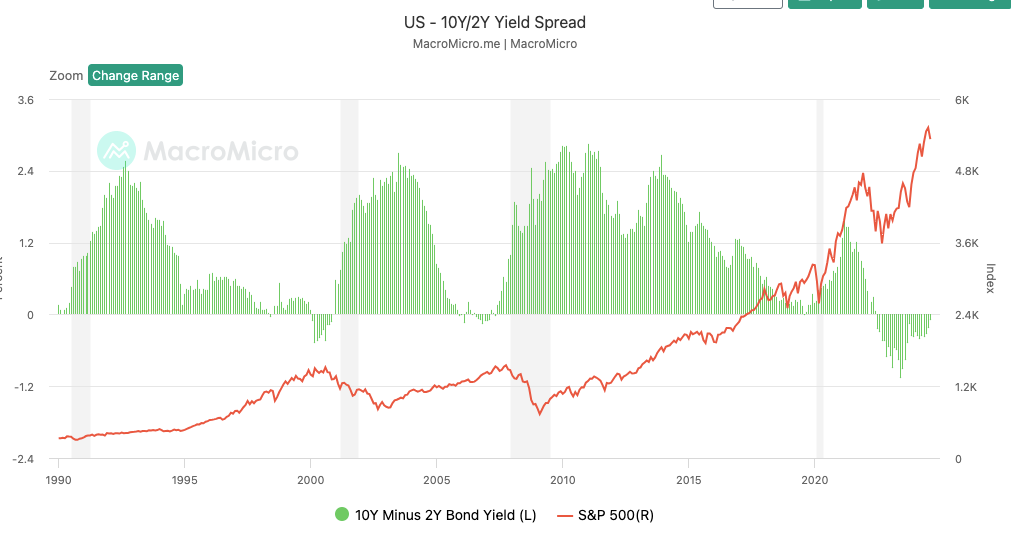

We have some other interesting data to consider. Since mid 2022, the yield curve has been inverted. I believe this is the longest yield curve inversion without a recession in history.

Historically, when the 10 year Treasury rate & 2 year Treasury rate un-invert, the recession is underway or about to start. Here’s a chart that shows this clearly that’s updated as of August 1st that shows we are 17 basis points from un-inversion. As of mid-day today, August 2nd, the yield curve is only 8.6 basis points from un-inversion. There have been some periods like October 2023 and January 2024 where the yield curve was within 15 basis points of un-inversion and then it spread further out. So, we’ll see if we actually un-invert.

On that note, some of the yield curve has un-inverted with the 2 year already, notably 20 year and 30 year Treasuries. However, that’s not the first time since 2022. It is, however, the deepest un-inversion so while these shouldn’t be taken as recession signals, it may signal the start of a more full un-inversion along the yield curve.

Naturally, markets are panicking today about a potential recession so equities have had a significant one day downward move. In addition, rates across the board have dropped significantly today:

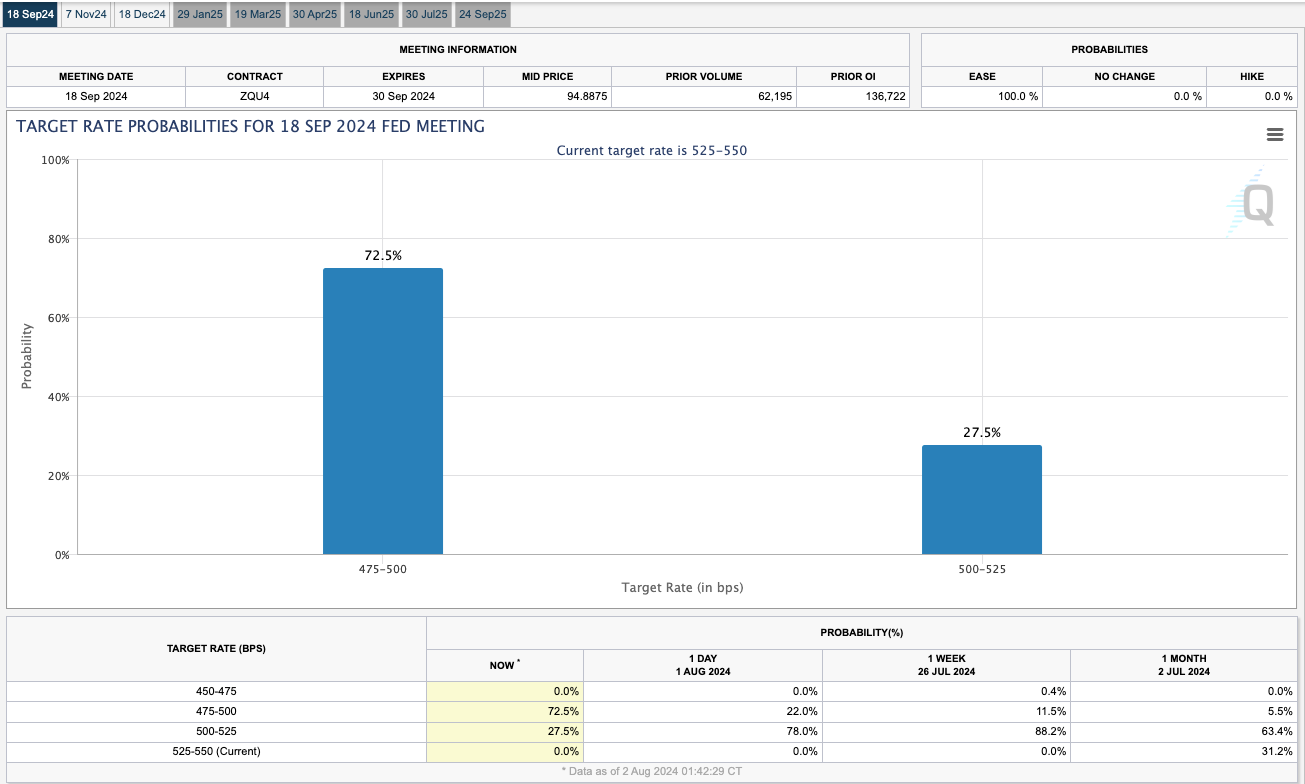

In response to this, we can also see CME’s FedWatch now indicates the market expects a high probability of a 50 basis point cut in September. That’s a dramatic change in one day.

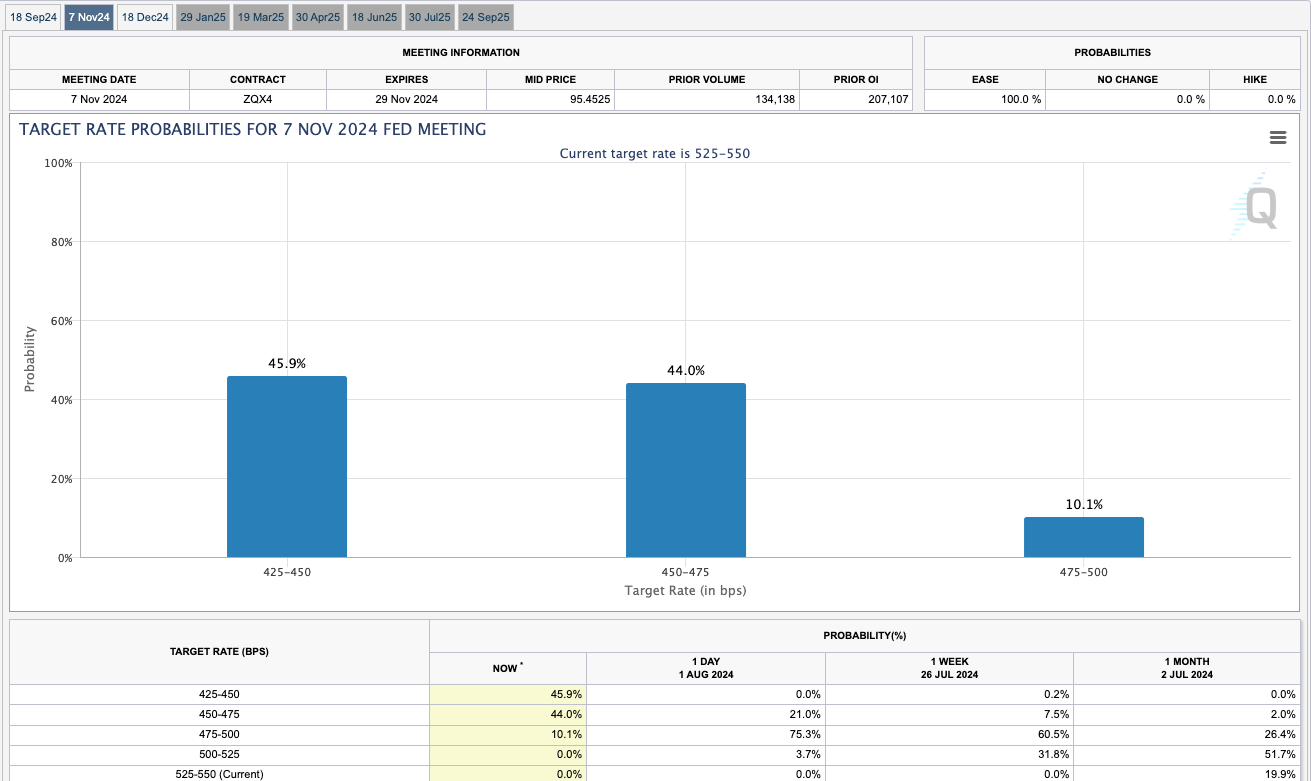

For the November meeting, the market is now forecasting a significant chance for an additional 50 basis points in cuts.

If the Fed cuts inter-meeting, then buckle up because that’s a very bad sign. No real expectations of that yet, just some market chatter.

Typically, the yield curve un-inverts because the short term Treasury yields begin to drop like a rock (and more deeply than the long end which still falls in response to lowered growth expectations) in anticipation of a recession. The Fed responds by cutting rates. The last few days, we are seeing short term rates drop faster than long term rates (both are dropping fast, though) which is potentially indicative of a recessionary un-inversion. If the un-inversion was driven by the long end climbing higher than the short end, then that itself would not be a recessionary signal even with un-inversion imho. For example, if the long end climbed to or remained around 4.5-5.0% while the short end gently fell to 4.25-4.75% with a few rate cuts, you’d have an un-inversion that isn’t really indicative of an upcoming recession.

What about inflation? It’s been ~2% for a while now. I use Truflation to keep track of real time inflation. Today, the real time inflation rate is 1.50% or well below the 2% objective for the Fed. However, the Fed does not use Truflation and they’d like to see their CPI metrics continue down further. Though, the Fed’s preferred inflation gauge is also at 2.2% YoY. Right in line. Yes, everything is more expensive (what do we expect after pandemic stimulus to the tune of 5 Ts? Future inflation was a easy call in 2020), but the Fed’s goal is not deflation (terrible for everyone) but rather a slowing in the rate of change in inflation.

So, did the Federal Reserve make a mistake by foregoing a rate cut on Wednesday? I think so. 25 basis points wasn’t going to do anything but potentially bolster confidence. Since inflation is in line, there was little to lose but plenty to gain. Time will tell though - it’s a tough job.

I like to utilize a number of models to see where we might be in the cycle:

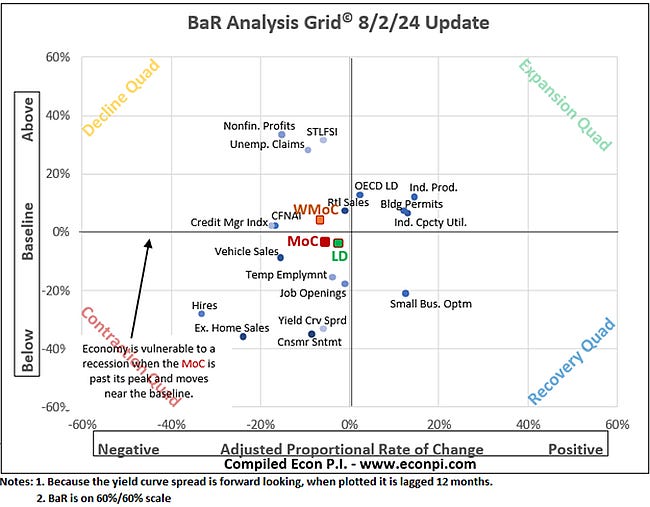

EconPi recession indicator has been triggered for some time, though they modified their model somewhat since a recession didn’t yet come to pass:

In addition, I follow the analyst New Deal Democrat on SeekingAlpha. They post a weekly indicator every Saturday. Here’s the latest one. Their model suggest we’re coming out of something/in an improving economic environment rather than going into a worse economic environment.

There is a few others I’ll follow, though these 2 are my preferred. As you can see, everything is a bit all over the place so there is some healthy skepticism to be had just due to pandemic distortions.

Now, the question is if this is just a fear driven narrative, or is a recession potentially underway? Personally, if I see the yield curve un-invert due to short rates dropping more combined with long rates, the Sahm Rule is triggered and remains that way after the next unemployment report, unemployment continues to rise, etc. then I think it’s safe to assume a recession is underway.

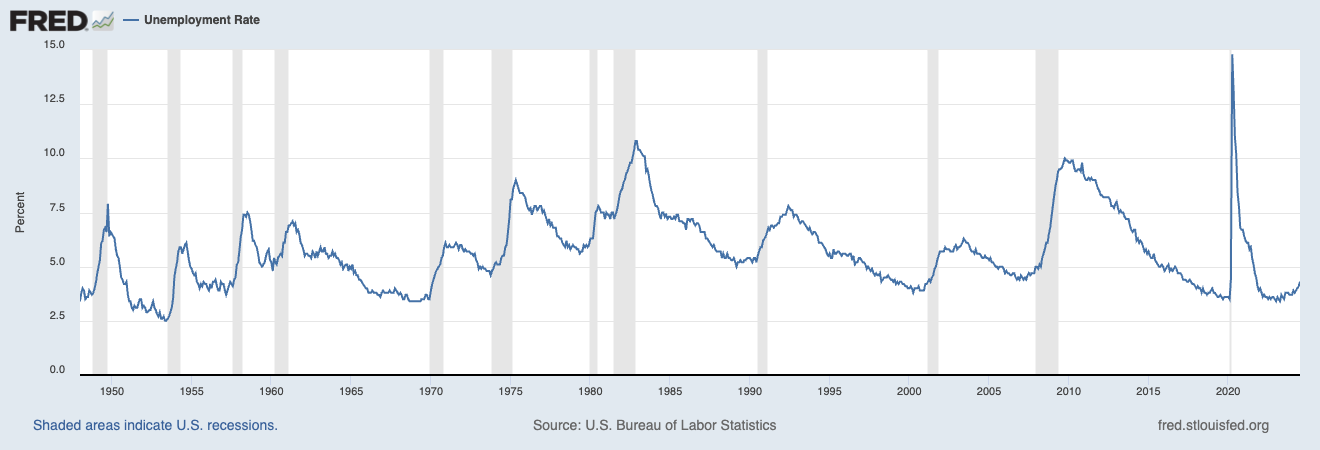

It’s also important to note that unemployment is a very lagging indicator. Typically, a recession is underway even with a low initial unemployment rate and unemployment will continue to rise and stay elevated into recovery.You can see that below - note the gray shaded areas are recessions:

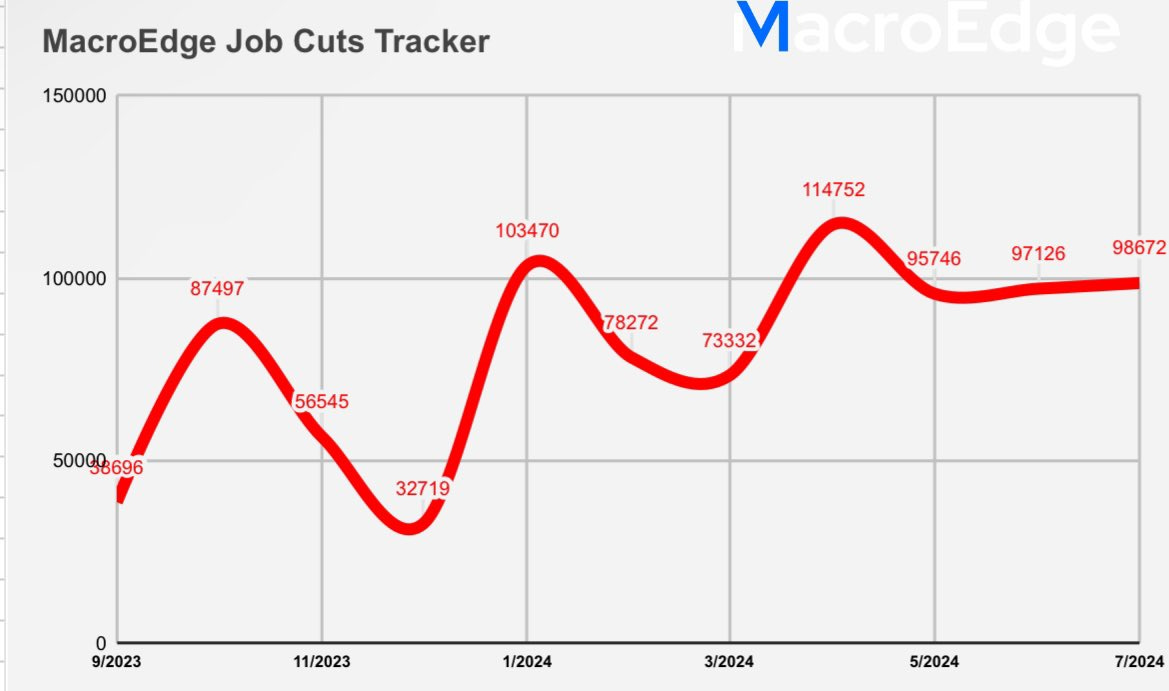

MacroEdge has also put together a real time jobs cut tracker this year. Just a heads up, they have a very bearish lean this year. However, I find the jobs cut tracker data helpful (noting it only captures rate of change in job cuts… which is flawed by itself and should be balanced with a more optimistic viewpoint):

So, what happens to equities after a recessionary un-inversion? Typically, equities climb during inversion as we’ve seen. After a recessionary un-inversion, a bear market typically follows with a 30% average decline. Here is a chart that shows markets typically climbing during inversion and then dropping with a recessionary un-inversion:

As I had shared in my May 8th article - lower rates are not a savior. You don’t want a Fed that dramatically cuts rates because it indicates economic pain is on the way or underway.

If we end up seeing things level out from here, then maybe we get the soft landing after all. Who knows?

As I’ve also mentioned, I don’t think it’s really possible to predict such a dynamic economy. Assume normalized rates will persist through time moving forward. By doing so as much as possible, I am not betting on rates moving one or way or another, but rather an asset or investment performing in a particular way due to starting valuation and execution in any interest rate environment. I think it’s easy to get into a lot of trouble if an investment rest on rates inevitably dropping (or doing something) and this doesn’t come to fruition.

Stay sharp out there. If we do get a bear market, stay level headed and be grateful for another chance at supercharging your returns.

PS Not Financial Advice.