Screening Utilities in March 2024

Hi everyone! Thanks again for reading.

In this newsletter, I plan to share at least 1-2 emails a month that help you identify potential high quality investments. Please note, most of my articles are not diving into deep due diligence and they are not meant to be financial advice, however, they are investments and/or ideas that I find compelling and may invest in.

Let’s jump in!

As mentioned in my earlier article, I am pretty interested in the utilities sector right now because valuations are quite interesting and below historical fair values after a period of overvaluation. Also, the majority of sectors in the market are otherwise quite expensive right now, and I always like to buy when an industry and/or stock is increasingly disliked. Betting against consensus has generally paid off for me the last few years (not always naturally, but in the majority of cases).

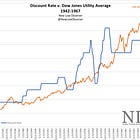

When looking at the Utility ETF (XLU) over the last 2 years, we can see there has been a continue downward momentum as rates have lifted from 0% to the highest in 20+ years.

Over the last 5 years, XLU has also significantly underperformed the broader market.

In general, there is a belief that when interest rates rise, utilities drop, when interest rates fall, utilities drop. I believe this is true to a degree - a number of retirees or income investors tend to rely on utilities for a safe return with a decent dividend to draw from. When Treasury rates are as high as they are now, there is a compelling risk-free way to generate a good return if you’re looking for the utmost safety. With Treasuries, the average investor is generally primarily looking to earn the yield rather than make a macroeconomic prediction about long term interest rates. That said, any stock investment is not simply about a yield. You are looking at valuation (and reversion to a historical valuation support level), earnings growth, and dividend growth as your total return.

Since the future is unknowable and it’s difficult to predict what happens to rates in the future, let’s consider a scenario of lower rates and higher rates separately.

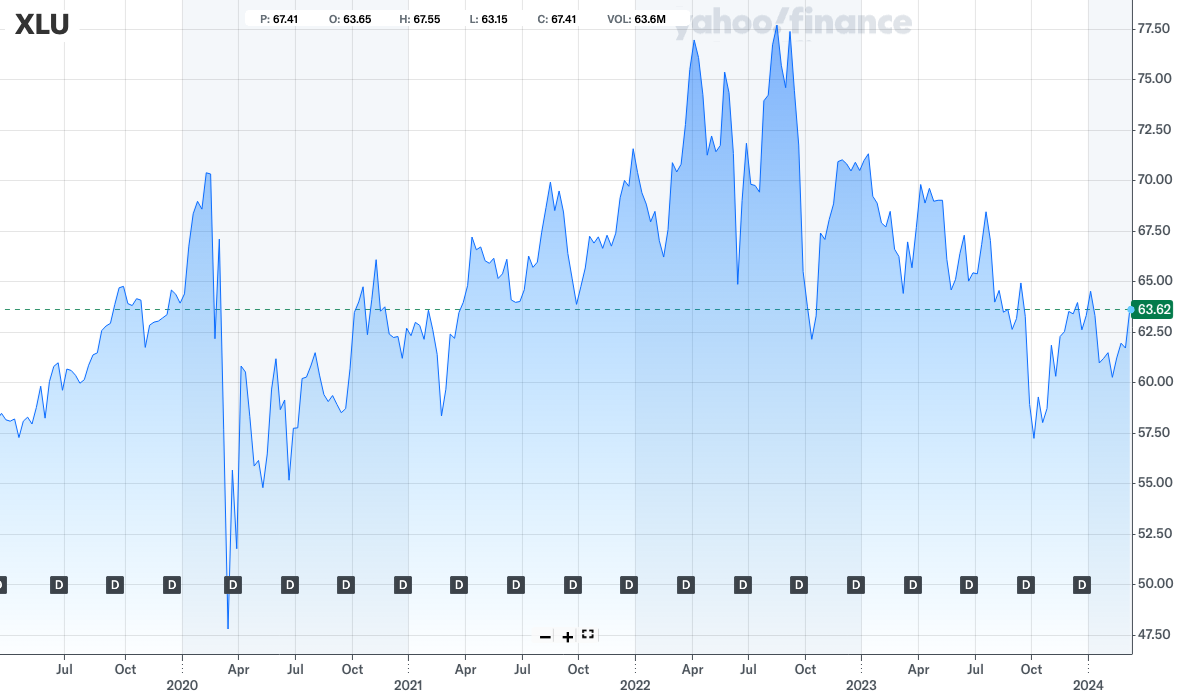

If we remain in a higher interest rate regime [meaning rates are steadily increasing and/or staying at a new relatively higher level, even if they fall for periods of time]: It’s probable utility prices will climb driving additional earnings driving additional dividend growth and long term shareholder capital appreciation. It does seem to me that interest rates are currently high relative to real time inflation (1.60% on Truflation & 1.49% for utilities specifically) and are likely to come down, even if just a 50-100 basis points. This may create a bid for utility stocks again. That said, in this scenario, we’re assuming rates will be steadily increasing and/or staying at/around current levels as an investment should not be made on the direction of something very difficult to predict. Utilities are tightly regulated so there are restrictions in their ability to raise prices dramatically in response. Generally speaking, utility price increases will lag inflation. So, in this case, we really want to buy a high quality utility that has as much pricing power as possible, as little regulation as possible, as cost-friendly of a price for its customer as possible [leaving room for price increases], a strong balance sheet/credit rating, and is relatively cheap on a historical basis for a nice margin of safety. A sufficient margin of safety can offset risks with increased regulation and pushback in the sector. As a reminder, in a prior rising rates regime, utility stocks climbed regardless of climbing interest rates:

If we revert to lower interest rate regime [though not going back to ZIRP but let’s say a 2.5-3.5% Federal Funds rate]: Utility stocks will likely receive a sustained bid as rate increase fears subside in this scenario. So, there is more likely to be a quicker reversion to the historical valuation. In addition, we can still expect utility prices will climb driving additional dividend growth and long term shareholder capital appreciation. If rates are cut dramatically in response to recession, these companies may still face headwinds though recession is not my base case scenario at this time.

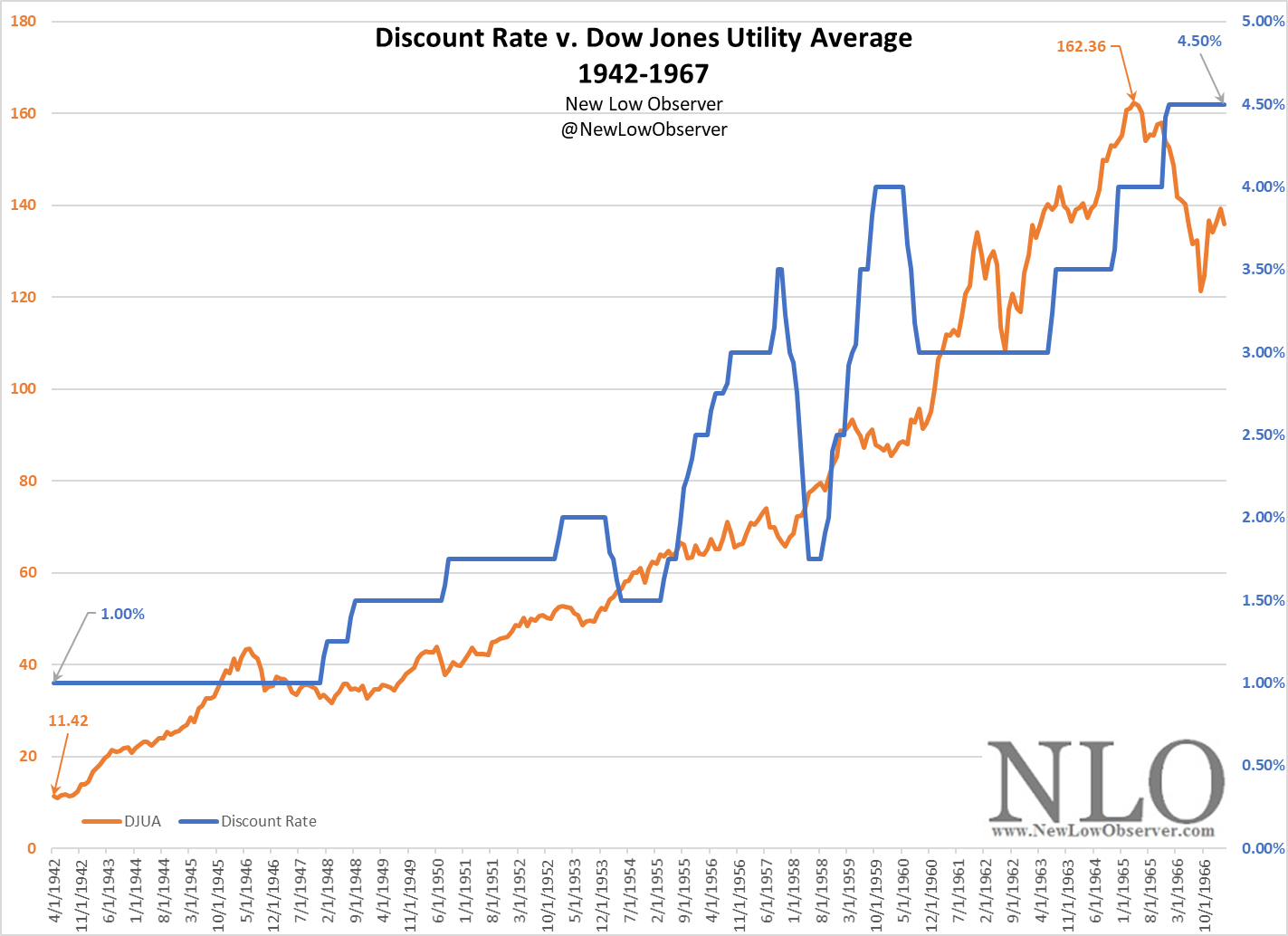

Looking beyond the XLU ETF, I’ve screened for quality utilities based on the following:

Long term debt/capital less than or equal to 60%

BBB+ or better credit rating

Minimum dividend yield of 3%

10+ years of dividends

>5% 5 year Avg Dividend Growth

Minimum 5% EPS yield

>5% EPS CAGR

We get a list of 12 names:

From here, I’m manually screening out 3 additional names:

KUNUF has the highest dividend growth rate at 51.83%, but just a quick look shows us this is not a consistent utility (gas in this case) and has had periods of earnings contractions and earnings growth.

ENGIY - Based on France, ideally US only since I don’t care to understand utility regulation abroad. Moreover, They have been mostly declining since 2007, recent growth is unexpected.

IBDRY - Based in Spain, ideally US only since I don’t care to understand utility regulation abroad.

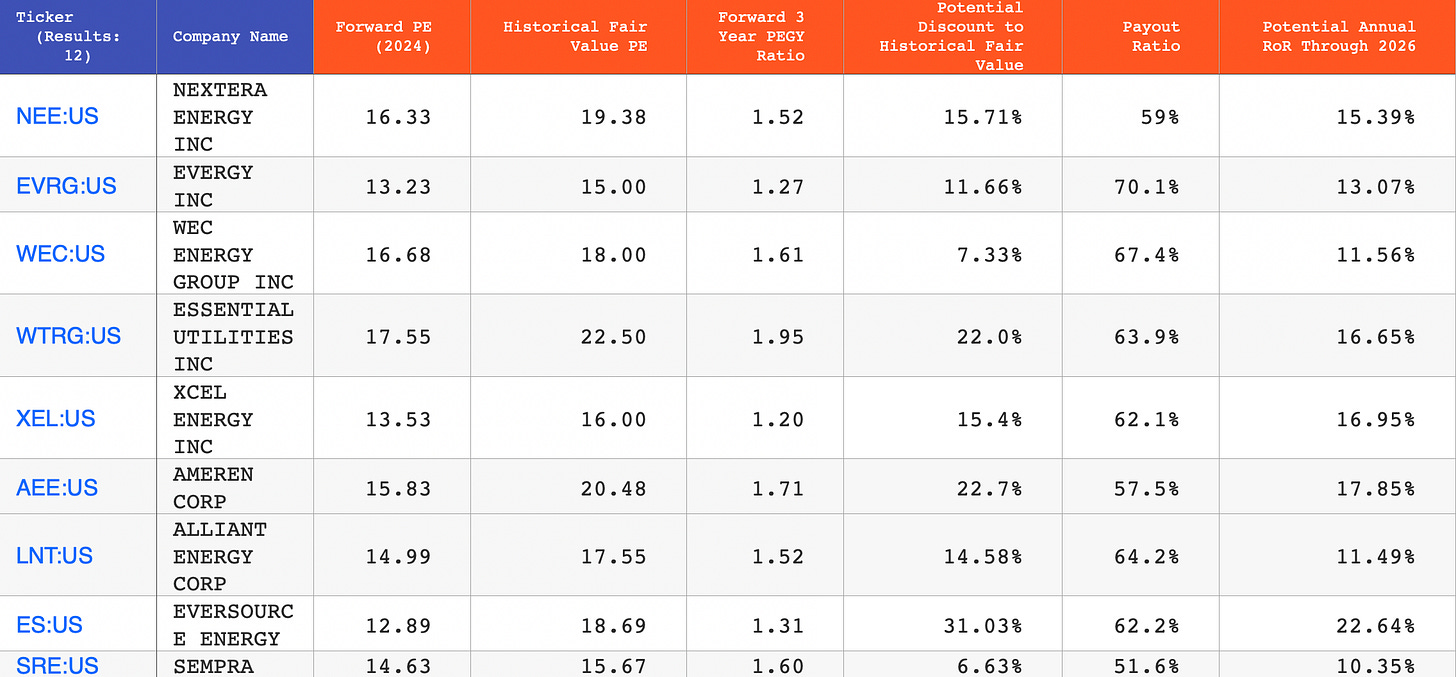

This leaves us with 9 names. Here is a table with my own data added to it - Forward PE, Historical Fair Value PE, Forward 3 Year PEGY Ratio, Potential Discount to Historical Fair Value, Payout Ratio, and Potential Annual Rate of Return through 2026. Please note, everything outside of the payout ratio is an art and my own personal assessments. I may be wrong.

From this list, I usually filter down by diving more deeply into the actual companies - management, what geographic area do they target, what regulatory issues they may face, what are their investments, etc.

My favorite names currently on this list are NEE, ES, WTRG, and EVRG in that order. I have invested into all 4 of these after due diligence. It’s worth noting NEE significantly outperformed the SPY over the last 20 years, while ES, EVRG, and WTRG slightly underperformed over the last 20 years.

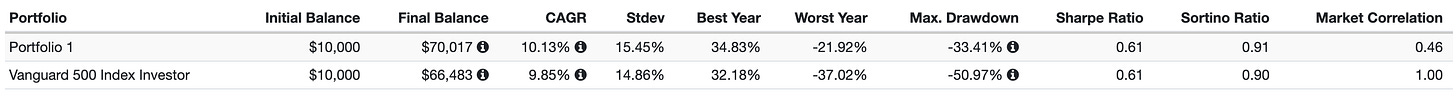

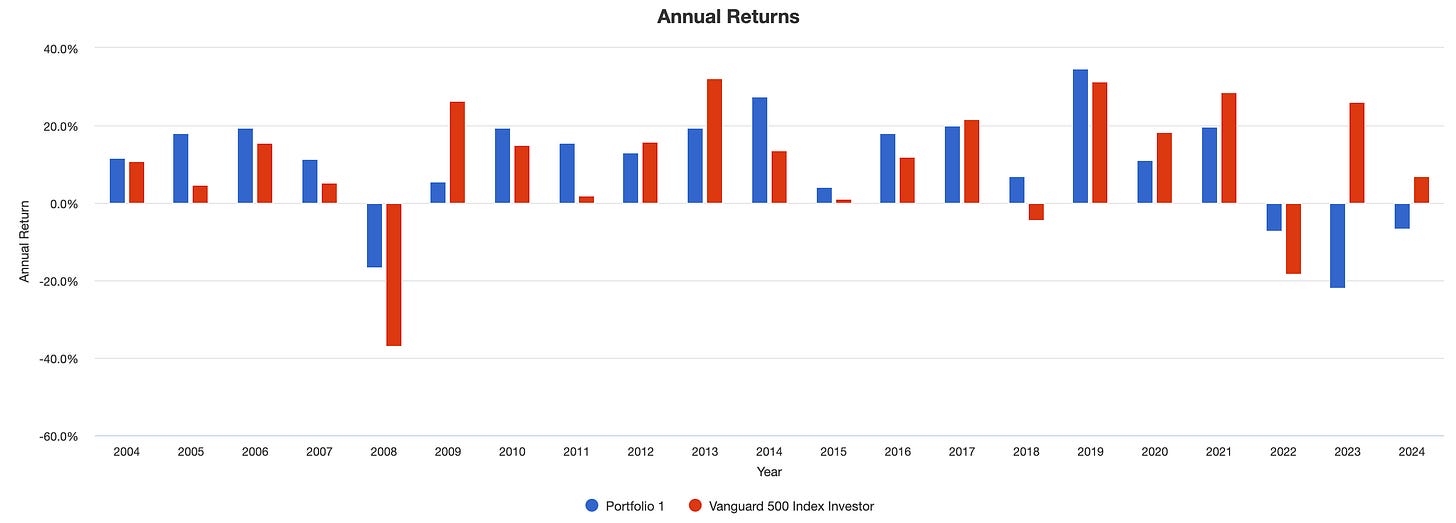

In a very quick back test on these 4 names (Portfolio 1), if I had invested $10,000 split into these 4 names in 2004 relative to the SPY:

This portfolio would also now be paying $2,698 a year in dividend income vs. $866 a year in dividend income from SPY with significantly less volatility in bad years and underperformance in good years:

Beyond these 4: For a utility, I think a margin of safety less than 10% is not very compelling so I will skip WEC & SRE. The rest do warrant some due diligence as I select additional utilities to build my own utility index.

As part of my greater portfolio, utilities in general will make a tiny % of my overall investments. That said, given it is an interesting sector in the market today, I am happy to selectively invest in utilities at this time.

What do you think about this article? Let me know your thoughts as I’m looking to improve.

PS Not financial advice.