Finding Pockets of Value at All Time Highs

Hi everyone! Thanks again for reading.

In this newsletter, I plan to share at least 1-2 emails a month that help you identify potential high quality investments. Please note, most of my articles are not diving into deep due diligence and they are not meant to be financial advice, however, they are investments and/or ideas that I find compelling and may invest in.

Let’s jump in!

Markets are at all time highs and it’s no longer just the Magnificent 7. The equal weighted SP500 index has joined the rally by finally exceeding it’s prior peak in late 2021 in late February 2024:

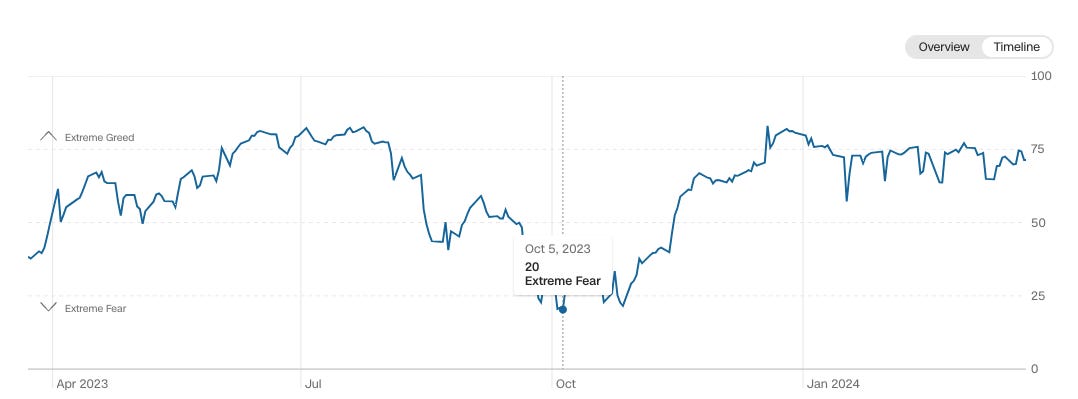

CNN’s Fear & Greed Index also continues to show a sustained period of greed after hitting peak fear in October 2023:

So, what’s next? If I had to venture a guess, a typical correction at some point this year as fear will naturally arise at some point. After such a strong rally, that would not be strange. So, while caution is warranted (when is it not?), there are still buckets of value & well-valued companies to consider at this time.

Here are 2 still disliked sectors:

Real Estate (REITs)

Utilities

Why? Broadly, interest rates and both have good reason to be depressed in valuation at this point for their own reasons.

I screened Utilities recently, you can see that article here:

Given that, I’ll focus on REITs as a disliked sector. Office valuations have taken a serious hit naturally, however, other pockets of the market are actually fairly compelling. There is a number of NNN & multi-family REITs that are compelling in valuation at this time. Do they have challenges? No question - many are adjusting to the higher rates environment or in the case of multi-family, excess supply as well. However, much of this pessimism is priced in already. It is going to take very little good news to lift these REITs assuming they continue to grow their earnings & dividends. That said, I don’t believe we are going back to a ZIRP environment and so the future valuation multiple for REITs may very well be lower than the last 15 years.

Here is a quick look at 2 REITs:

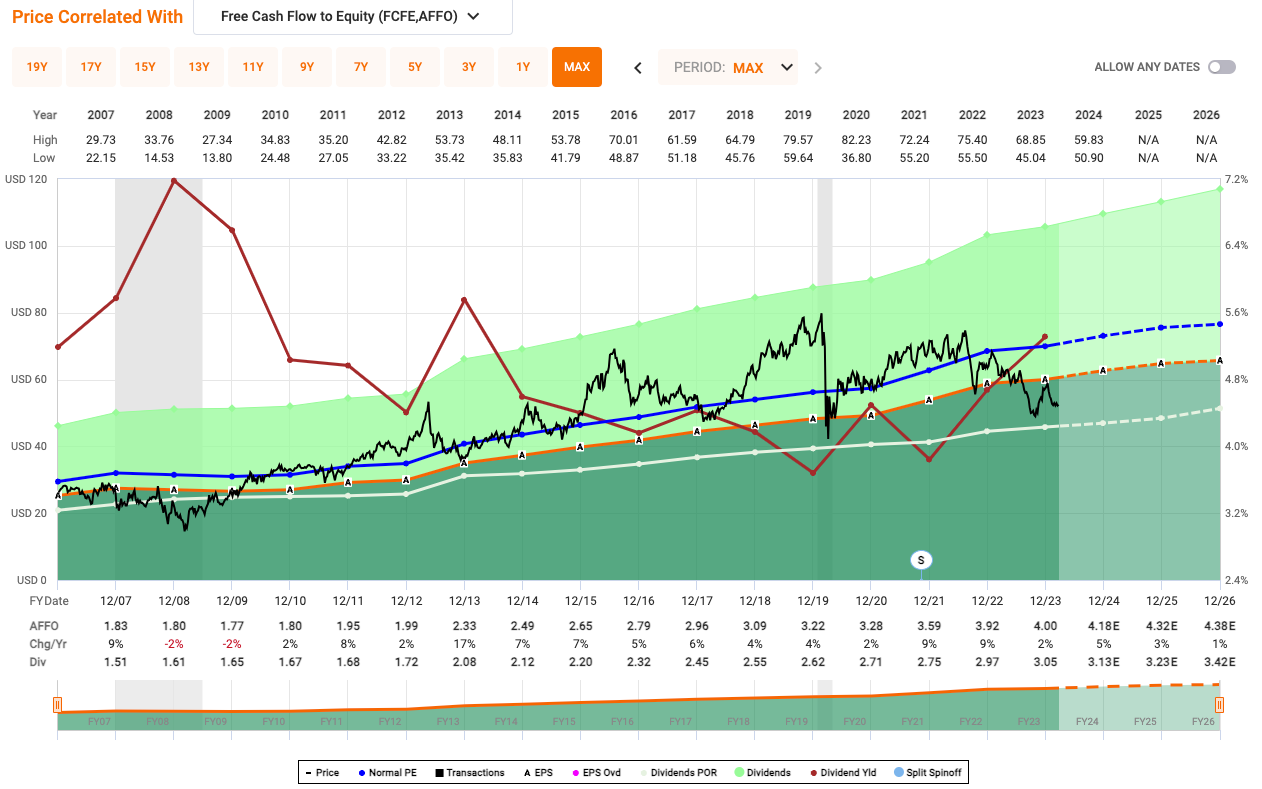

Realty Income (O) is the 4th largest REIT in the world now that its closed on its acquisition of Spirit Realty Capital. It has 36.9% LT Debt/Capital, an A- Credit Rating, and has delivered decent performance since inception. However, the last few years have been less than stellar due to pandemic risks followed by interest rates rocketing higher. Given that, O is at the steepest valuation discount (12.99x P/AFFO) since late 2009 today. With a 5.88% dividend yield and continued earnings growth, O is an interesting value investment to consider in this environment. While O has typically traded around a 17.48x P/AFFO multiple since GFC, I think it’s more likely to settle somewhere between 13-15.5x P/AFFO. At a 15.34x P/AFFO based on expected 2026 earnings, O may potentially return 14.34% a year including dividends.

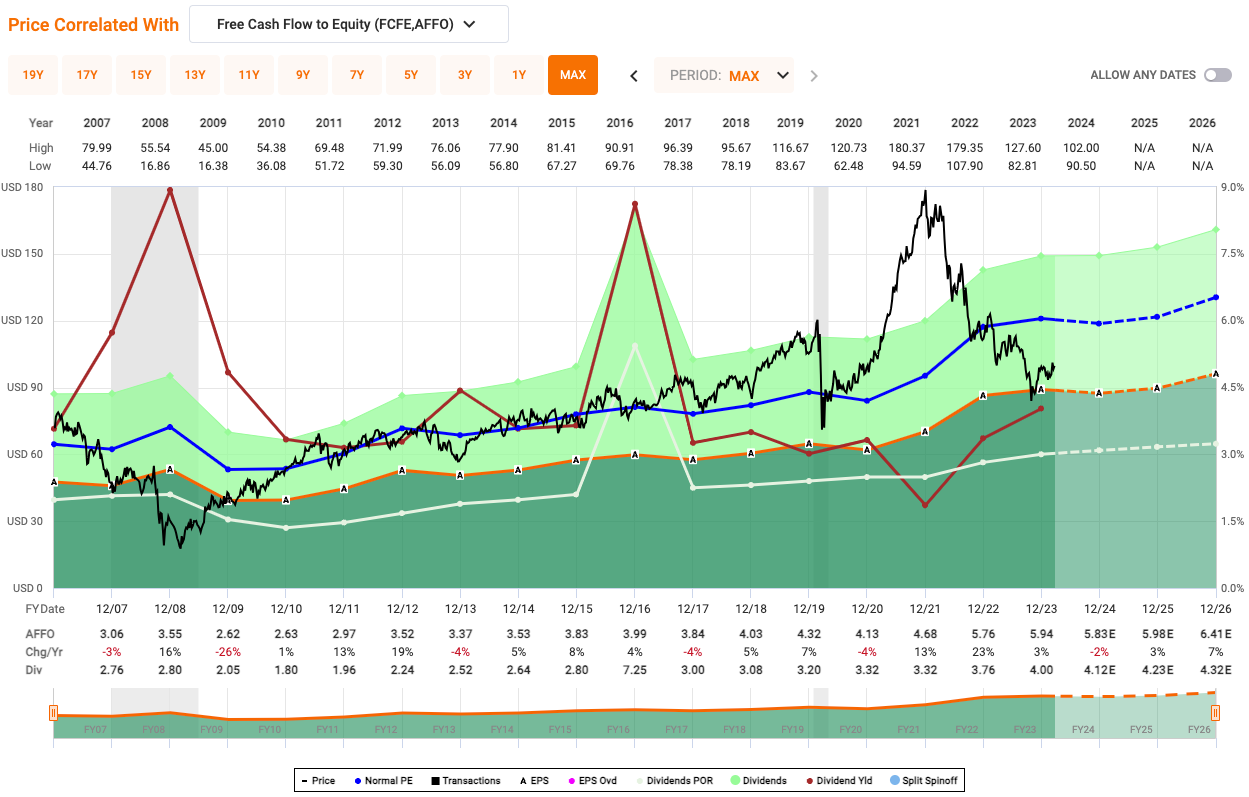

Camden Property Trust (CPT) is one of the largest multifamily REITs in the world. It has 40.28% LT Debt/Capital, an A- Credit Rating, and has delivered decent performance since inception. However, after becoming wildly overvalued in late 2021, CPT has fallen back down to reality and then some. In addition, CPT faces headwinds from multi-family oversupply along with interest rates that are priced into 2024 earnings expectations in particular. Today, CPT is at a reasonable valuation discount (16.85x P/AFFO) coinciding with mid 2010, 2013, and the pandemic lows. With a 4.13% dividend yield and accelerating earnings growth after 2024, CPT is an interesting value investment to consider in this environment. While CPT has typically traded around a 20.36x P/AFFO multiple since GFC, I think it’s more likely to settle somewhere between 16-19x P/AFFO. At a 18.37x P/AFFO based on expected 2026 earnings, CPT may potentially return 10.14% a year including dividends.

In the case of both of these REITs, they face serious industry headwinds. However, they both seem to be in a position to adjust and continue to succeed moving forward. In an environment of higher interest rates, it’s not unexpected to take a few years to adjust to higher cap rates.

Other interesting REITs I’ve invested in over the last few months: VICI, MAA, REXR, AVB

Beyond REITs, here are 2 high quality companies that have interesting valuations at this point:

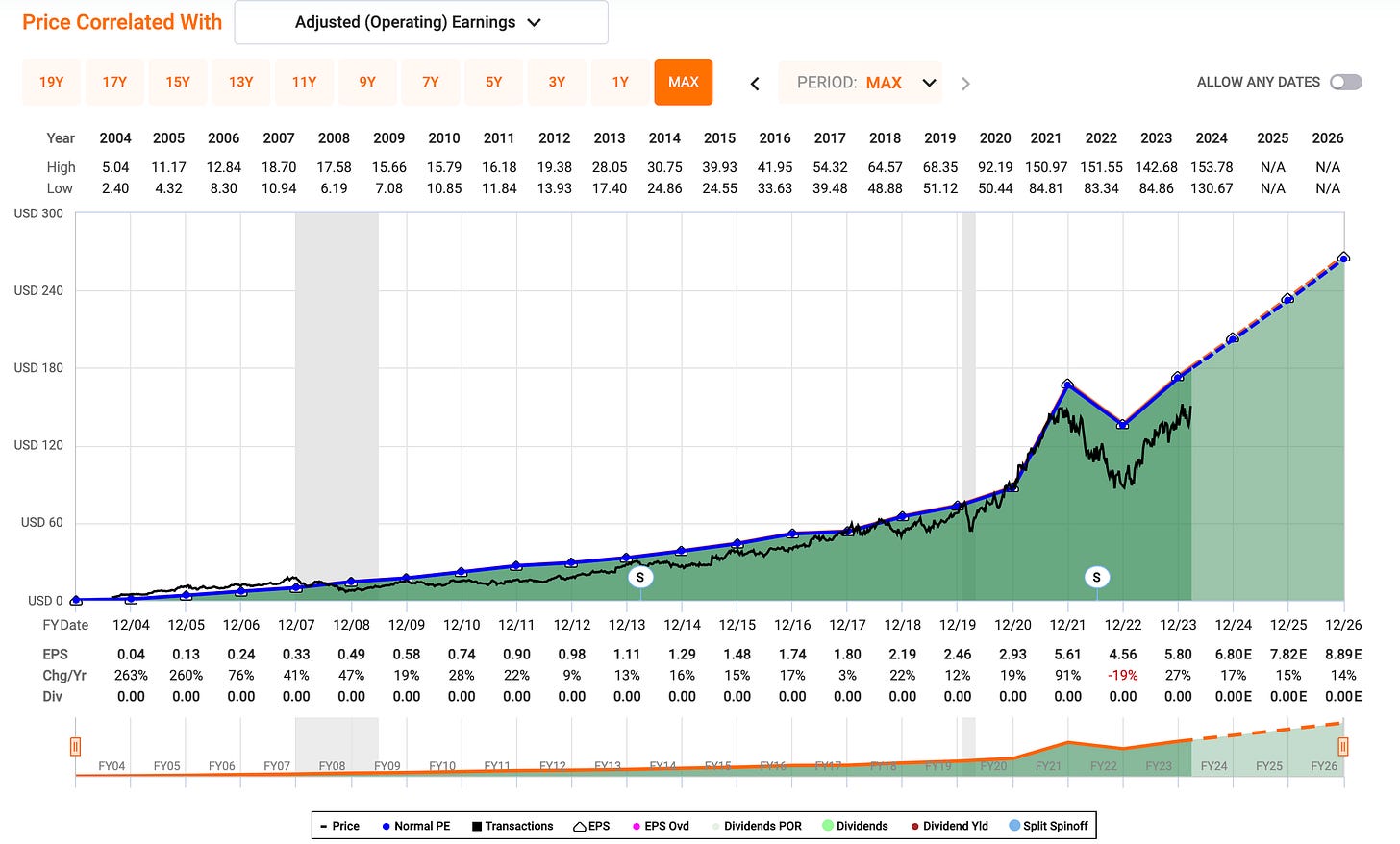

Google (GOOGL) - Out of the Mag7, Google seems like a fairly compelling investment at this point due to poor sentiment in the short term combined with strong fundamentals. GOOGL has an AA+ Credit Rating, 8.21% LT Debt/Capital, a 15.33% 3 year expected average growth rate, and a 5 year expected PEG ratio of 1.59. While tech has gone through a (silent?) recession since 2022, Google like much of the Mag7 shrugged it off fast and continued to grow in a more difficult operating environment delivering outstanding results in 2023. Moreover, in my opinion, it’s likely Google will both clean up its focus and initiate a dividend sometime in the next few years. It’s reasonable to expect that in the next 5-10 years, an investment in Google is likely to do well. However, in the short term, a lot of it’s growth is priced in near fair value so there can be fluctuations to the downside as another point to add additional shares.

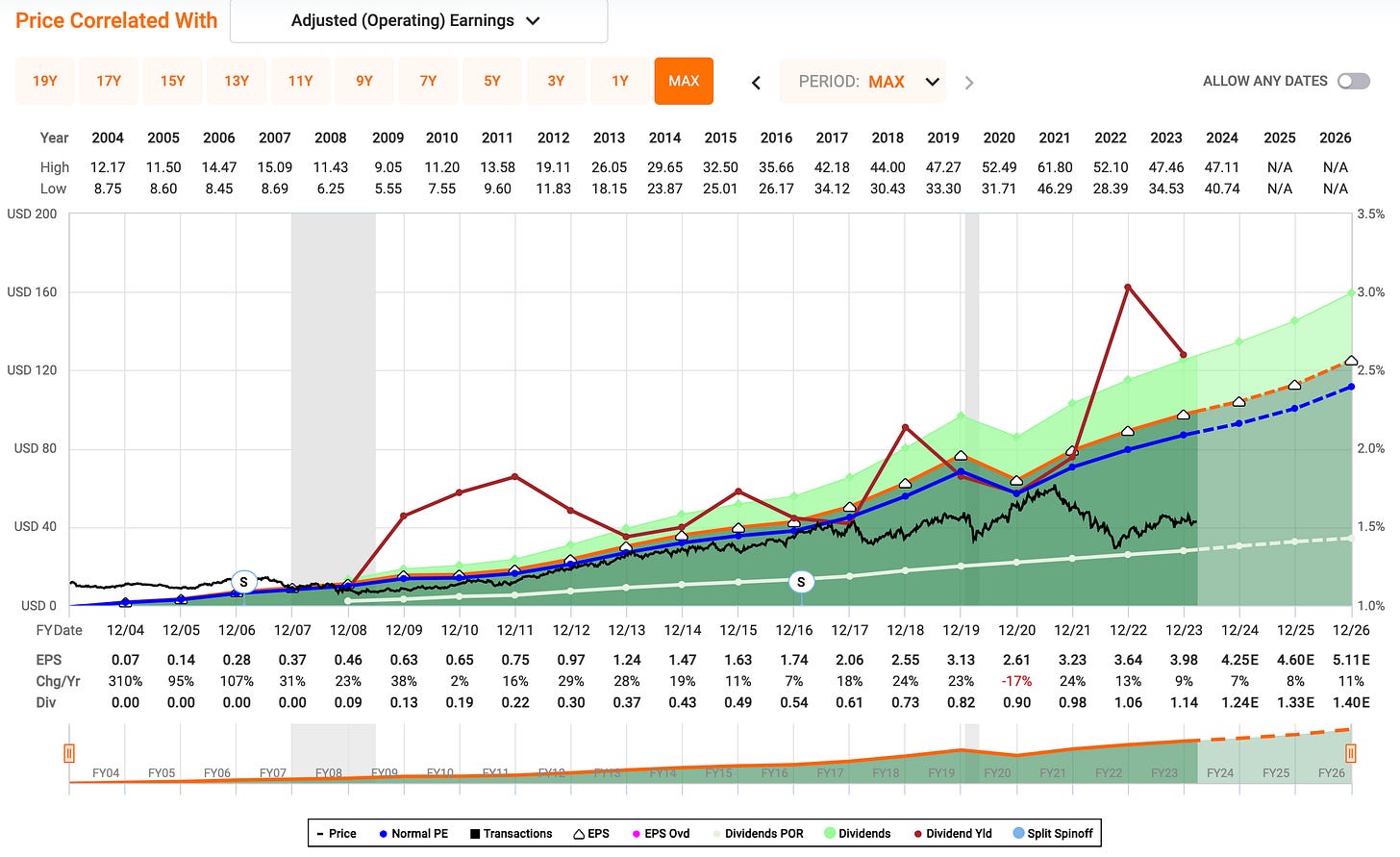

Comcast (CMCSA) - Comcast is a stand out, high quality company facing headwinds that have led to a significantly lowered valuation the last few years. That is exactly what makes it compelling at this time. Comcast has a A- credit rating, 54.12% LT Debt/Capital, a 2.90% dividend yield, a 9.41% 5 year dividend growth rate, and a 28.64% dividend payout ratio. At it’s current price ($42.74), Comcast is priced at a 10.58x PE ratio and based on its expected 3 year growth rate (8.33%), a very enticing 0.91 PEGY ratio. How much cheaper can it become from this point if earnings growth is realized? And if we re-rate Comcast to a new valuation multiple right around the same level as today under this scenario, what kind of return can we see? Through 2026, 12.43% ann RoR at a 10.86x PE. Though if expected earnings growth is realized, why not 13.58x PE for a 21%+ ann RoR? Overall, this is a compelling investment because a lot of the bad news is priced in while very little of the good news is priced in. This is the kind of investment that can increase rapidly in stock price on any better-than-expected news.

Other interesting companies I’ve invested in over the last few months:

In any environment, there can be a number of compelling stocks and sectors. While many are stretched today, these are a few I’ve personally invested in recently. As always, if my reason for investing in any company is invalidated, I’ll sell as soon as I realize it [at a gain or loss] and invest into something else.

PS Not financial advice.